It’s a ‘Made in America tax plan’. but it could help the worlds poor

The Biden administration has continued its charge to drive through international corporate tax reforms. Treasury Secretary Yellen’s call for an end to the race to the bottom. At the same time, the Biden administration released its ‘Made in America tax plan’.

Central to the ‘Made in America’ plan is the piece about changing the incentives for other jurisdictions, by encouraging a robust, global minimum corporate tax plan.

US Treasury Secretary Janet Yellen has signalled that the US is throwing its full weight behind a global minimum corporate tax rate – and framing this quite explicitly as an end to the race to the bottom.

This is a powerful narrative shift, in favour of tax justice. Once, the defenders of the race to the bottom wrapped themselves – unchallenged – in the mantle of “tax sovereignty”. Every state must have the freedom, they opined, to set the tax rules and rates they wished – regardless of the damage it might do to their neighbours. Anything else would be an unconscionable erosion of tax freedom…

The US plan to shake up the global tax system amounts to the “most radical rewrite of international tax rules” for more than a century and will have a “seismic impact” on a number of EU countries that act like ‘Tax Havens’ from Ireland to Luxemburg Biden’s Tax reforms will hit hard.

In 2018 The European Commission pointed out seven EU states with policies facilitating tax evasion: Belgium, Cyprus, Malta, the Netherlands, Ireland, Hungary and Luxembourg. This provoked the indignation of member states defending fiscal sovereignty.

“There are no tax havens in the EU, but it would be absurd to deny that there aren’t aggressive tax planning practices,” Pierre Moscovici, the Commissioner for economic affairs, said during the first hearing of the committee on financial crimes.

The EU has voted down constantly any real measures to stop Tax avoidance. November 2019 EU Tax avoidance draft bill failed in a Council vote,

12 EU countries reject the move to expose companies’ tax avoidance.

They include Luxembourg, Malta, Cyprus, Latvia, Slovenia, Estonia, Austria, Czech Republic, Hungary, and Croatia. Sweden also voted against the proposed rule, but because its government feared that the directive might water down their higher standards on transparency.

The proposal would have forced firms to reveal profits made and taxes paid in each EU country. Read more…

Oxfam’s analysis finds that five EU member states – Cyprus, Ireland, Luxembourg, Malta and the Netherlands – would be listed as tax havens if the EU criteria on Tax havens were applied to them.

These countries are referred to as tax havens because of the country’s taxation and economic policies. Legislation heavily favours the establishment and operation of corporations, and the economic environment is very hospitable for all corporations, especially those invested in research, development, and innovation.

Tax havens deprive countries and their citizens of hundreds of billions in pounds dollars and Euro’s, fuelling inequality and poverty.

Since 2014, a huge number of documents in the form of The LuxLeaks, The Panama Papers and Paradise Papers have revealed how powerful corporations and super-rich individuals are exploiting a rigged global system that allows them to avoid paying their fair share of tax. And it’s the world’s poorest people who pay the price.

Our world is not short of wealth. The size of the global economy has quintupled over the past 30 years. In 2020, its value reached nearly $88 trillion.

Yet, the gap between rich and poor gets wider, with a massive increase in wealth at the top, while the total wealth owned by those at the bottom is falling. Since 2015, the richest 1% have more wealth than the rest of the world combined.

Such extreme economic inequality is being fueled by an epidemic of tax evasion and avoidance that has reached an unprecedented scale.

While millions across the world live in poverty, rich individuals and companies, exploiting the secrecy provided by tax havens, are continuing to dodge their taxes, depriving the poorest countries from being able to provide vital services.

Although it’s said Joe Biden has a certain soft spot for Ireland that soft stop stops when it’s damaging the American economy. The US plan threatens a key economic advantage for Ireland — its 12.5 percent corporate tax rate.

The Biden plan, described as “seismic” in its potential impact, is seen as a dramatic shift, distancing the US from decades of prioritising the tax sovereignty of nations. The world’s largest economy has long resisted calls for the global treaties that tax reformers argued were needed to ensure that powerful multinational companies pay their fair share of taxes.

Under the plan promoted by Washington, set out in a document sent to 135 countries negotiating tax reforms at the OECD on Wednesday, tech companies and large conglomerates would be forced to pay taxes to national governments based on the sales they generate in each country, irrespective of where they are based.

The Biden administration also threw its weight behind work to establish a global minimum tax rate, which would see some of the world’s biggest economies agree on a minimum rate of tax on company profits.

The current rate of corporation tax in the US is 21%, compared with 19% in the UK and 12.5% in Ireland, one of the lowest among EU nations.

Of course, this will not affect the UK The Chancellor plans to raise corporation tax by 6% to a new 25% rate from 2023 raising an additional £22bn in revenues, it still beggars belief that Sir Keir Starmer opposed such a tax rise going against all accepted Labour economic and now it seems world thinking on corporation tax.

Countries could impose higher corporation tax rates, but not go below the agreed threshold. The agreement is designed to stop countries luring businesses by offering tax discounts.

This collapses the Irish economic model

The proposals are designed to tackle the very low rates of tax paid by the digital giant’s Google, Facebook and Apple, and major brands like Nike and Starbucks, which have become adept at using complicated webs of companies to shift profits out of major markets like the UK, where most of their revenues are earned, and into low-tax jurisdictions like Ireland Cyprus, Luxembourg, Malta and the Netherlands and the Caribbean. Economists estimate that the sums lost to exchequers around the world from profit-shifting have risen as high as $427bn (£311bn) annually.

Ireland is one of the biggest tax havens in the world according to a report in the Irish times, costing other countries almost $16 billion (€13.5 billion) in lost revenues each year, according to a major new report.

The UK-based Tax Justice Network, in its inaugural State of Tax Justice report published on Friday, ranked Ireland as the ninth worst offender in the world in terms of tax loss inflicted on other countries, and the fourth worst in Europe.

The report claimed to be the first study to measure thoroughly how much every country loses to both corporate tax abuse and private tax evasion.

It said countries are losing more than $427 billion in tax each year to international corporate tax abuse and private tax evasion.

Overall, $245 billion is directly lost to corporate tax abuse by multinational corporations, while $182 billion is lost to private tax evasion.

Tax lost by other countries due to Ireland was put at $16 billion, with $10 billion due to global private tax evasion and $6 billion from global corporate tax abuse.

The report said Ireland was responsible for 3.7 per cent of all global tax losses.

Tax competition

Tax competition is an emotive issue for politicians, however, who will often contort themselves in order to defend Ireland’s record.

But probably the vast majority of economists would agree with the World Bank’s Michael Keen and Jim Brumby who wrote in 2017 that “headline corporation tax rates have plummeted since 1980, by an average of almost 20%”.

For Keen and Brumby, a wide range of factors are responsible for this downward trend, but tax competition — countries undercutting one another on rates in order to lure multinationals — has certainly been one of them.

Within that 30-year window that Yellen spoke of, Ireland has become a poster boy for a model of development that hinges on its low corporate tax environment. Successive Irish governments slashed corporation tax rates throughout the 1990s, before introducing the world-famous 12.5% rate between 1999 and 2003, which remains in place, a cornerstone of the country’s model for attracting foreign direct investment.

Because of it, Ireland has punched well above its weight.

Figures from 2017, reproduced recently by the International Monetary Fund, suggest that Ireland’s share of total global foreign direct investment was about 2.5% in that year. That’s hugely disproportionate, given that the Irish economy accounted for just about 0.4% of world gross domestic product in that year.

It must be said that we’re not the worst offenders by any stretch, not even within Europe.

In Europe, Hungary offers a 9% rate. Luxembourg’s 17% standard rate combined with various sweetheart tax deals for individual companies mean that the tiny, land-locked country, with its 0.1% share of global GDP, enjoyed a whopping 12.8% share of world foreign direct investment in 2017.

Expressed as a percentage of its world GDP share, it means there’s an over 7000% gap between Luxembourg’s country’s share of global investment and the size of its output. In Ireland, it’s about 264%.

But as Bloomberg economist David Fickling wrote this week, “The trouble is, with Ireland running a 12.5% rate and the likes of the Cayman Islands and British Virgin Islands not taxing corporate profits at all, it’s a race to the bottom that rich-country governments can only win by either drastically cutting spending or by shifting more and more of the fiscal burden onto the shoulders of middle-and working-class voters.”

Corporation tax receipts have been an extremely lucrative revenue stream for the Irish government, particularly over the past half-decade or so. Last year alone, the Exchequer took in €11.8 billion from corporation tax, roughly 20% of Ireland’s total tax take.

The bottom line is that proposed under BEPS could cost the Irish exchequer an estimated €2 billion per year.

Nevertheless, Minister for Finance Paschal Donohoe said this week that the OECD remains the best forum for discussing international tax reform.

“What Ireland and other countries will do is put forward their case within with the OECD, and we’ll work inside that process to try and influence an outcome that recognises the role of small economies in the global economy,” the Fine Gael TD said.

Other EU countries wont fair so good either

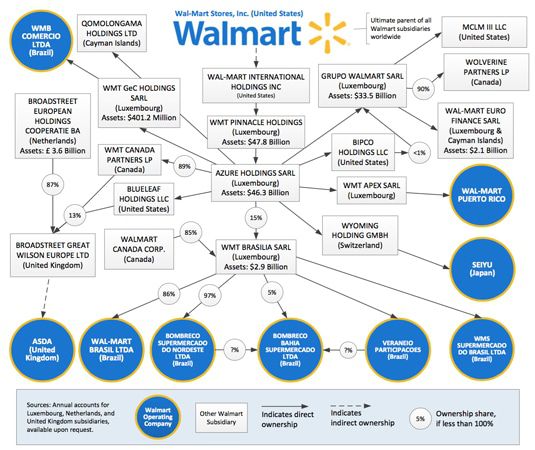

Walmart hid $76bn of assets in tax havens across the world, including $64.2bn managed by 22 different subsidiaries in Luxembourg, where Walmart has no stores, according to a study published in 2019.

The study, published by campaign group Americans for Tax Fairness and funded by the United Food and Commercial Workers International Union, alleged that Walmart has “kept its tax haven subsidiaries secretive by burying mention of their existence”. Walmart denied the claims.

The authors claimed Walmart’s global empire keeps billions of dollars of assets away from the prying eyes of the taxman via a network of shell companies in Luxembourg, the Netherlands and a host of Caribbean countries known for their low taxes.

Taxpayers spend £11bn to top up low wages paid by UK companies

Research published by Citizens UK found that companies in the UK are paying their workers so little that the taxpayer has to top up wages to the tune of £11bn a year. The four big supermarkets (Tesco, Asda, Sainsbury’s and Morrisons) alone are costing just under £1bn a year in tax credits and extra benefits payments.

This is a direct transfer from the rest of society to some of the largest businesses in the country. To put the figure in perspective, the total cost of benefit fraud last year was just £1bn. Corporate scrounging costs 11 times that.

Worse, this is a direct subsidy for poverty pay. If supermarkets and other low-paying employers know they can secure work even at derisory wages, since pay will be topped up by the state, they have no incentive to offer higher wages.

None of this makes sense. We are all, in effect, paying a huge sum of money so that we can continue to underpay the 22% of workers who are earning below the Living Wage – the level at which it is possible to live without government subsidies. The only possible beneficiaries are business owners.

Walmart not only indirectly steals money from economies by not paying a fair share of tax

Research published by Citizens UK found that companies in the UK don’t pay staff enough and therefore forcing them to rely on government assistance. ASDA, as well as other big supermarkets (Tesco, Sainsbury’s and Morrisons), are costing the taxpayer just under £1,000,000,000 a year in tax credits paid to top-up criminally low salaries.

Support Independent Journalism Today

Our unwavering dedication is to provide you with unbiased news, diverse perspectives, and insightful opinions. We're on a mission to ensure that those in positions of power are held accountable for their actions, but we can't do it alone. Labour Heartlands is primarily funded by me, Paul Knaggs, and by the generous contributions of readers like you. Your donations keep us going and help us uphold the principles of independent journalism. Join us in our quest for truth, transparency, and accountability – donate today and be a part of our mission!

Like everyone else, we're facing challenges, and we need your help to stay online and continue providing crucial journalism. Every contribution, no matter how small, goes a long way in helping us thrive. By becoming one of our donors, you become a vital part of our mission to uncover the truth and uphold the values of democracy.

While we maintain our independence from political affiliations, we stand united against corruption, injustice, and the erosion of free speech, truth, and democracy. We believe in the power of accurate information in a democracy, and we consider facts non-negotiable.

Your support, no matter the amount, can make a significant impact. Together, we can make a difference and continue our journey toward a more informed and just society.

Thank you for supporting Labour Heartlands