Thames Water’s Downward Spiral: Debt, Dysfunction, and the Folly of Privatisation

Oh dear. Yet another grotesquely overpaid fat cat has oozed his way to the top of one of our once-great national utilities, ready to gorge himself on the carcass of Thames Water while customers suffer, infrastructure crumbles, and sewage gushes into our waterways.

Thames Water has named Chris Weston, a former executive at British Gas, as its new chief executive, offering a salary package of up to £2.3 million annually. Tasked with the formidable challenge of steering the heavily indebted utility back on course, Weston assumes his role on 8 January. He steps into the shoes of Sarah Bentley, who resigned abruptly in June after a three-year tenure, marked by public outcry over the company’s disposal of sewage into British waterways.

The announcement of Weston’s appointment coincided with a revelation about the staggering debt burden accumulated during years of private ownership, laying bare the financial struggles faced by Thames Water. With a debt tally reaching £18.3 billion, executives admitted the water supplier lacked the funds to meet a looming £190 million loan repayment due in April next year.

I suppose we must offer the obligatory platitudes about Mr Weston’s “proven track record” and his empty promises to “improve performance”. But let us have no illusions. This is the classic pattern of modern corporate Britain: the remorseless transfer of vital assets from public stewardship into the hands of ruthless privateers whose only true allegiance is to their own pay packets.

And what a pretty packet it is too! Up to £2.3 million a year for Mr Weston’s services. Tell me, what services can possibly justify such outlandish rewards? Supping fine wines with fellow fat cats while customers struggle with their bills? Signing off on massive dividends to Thames Waters foreign owners while sewage spills into the actual Thames? Even his predecessor felt obliged to forgo her (much smaller) bonus, so outraged were MPs and the public.

But we know how it goes with these things. Today’s self-abnegating gesture becomes tomorrow’s long-forgotten memory. Business picks up for a short spurt as government bailouts begin. Snouts return to trough for another round of guzzling, how they must chortle at our gullibility!

Even now, staggering under debts of nearly £20 billion (an unbelievable sum!), Thames Water’s first priority is to wheedle more money from its beleaguered customers. Bills up 40%, six times the rate of inflation! Just think of the suffering that will cause to pensioners and hard-pressed families already desperate to heat their homes. But do these corporate cronies shed a single tear? Again – Not when there are dividends to be paid to its foreign masters!

The Continued Plunder of Our Commons

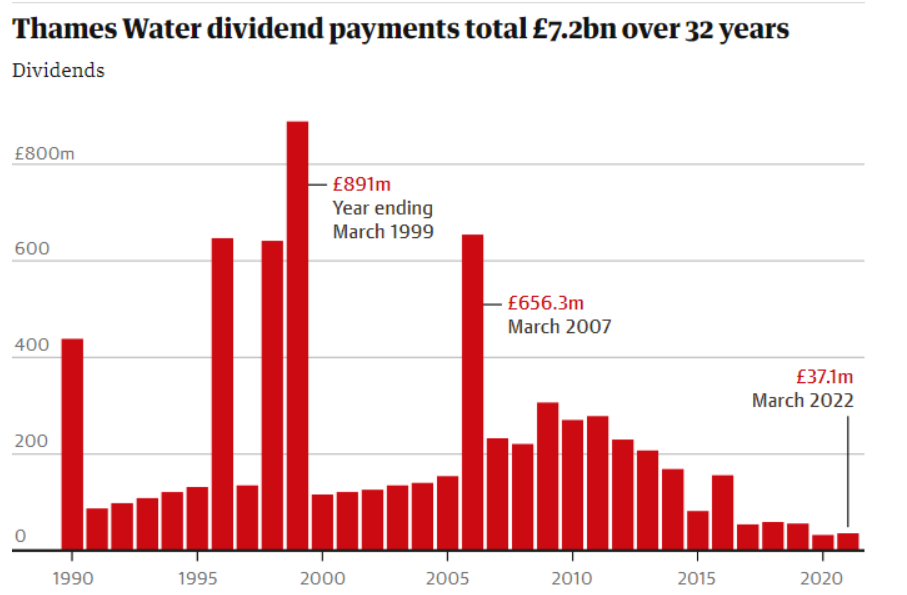

Thames Water between 1990 and 2022 reveal a story that is echoed to some degree across the industry. The figures show how privatisation – which was intended to lead to a new era of investment, improved water quality and low bills – turned water into a cash cow for investment firms and private equity companies, none more so than the Australian infrastructure asset management firm Macquarie which, with its co-investors, bought Thames Water in 2006 from the German utility firm RWE for £4.8bn.

By the time Macquarie sold its stake in Thames Water in 2017, debts had more than tripled from £3.2bn to £10.5bn, unadjusted for inflation. Its pattern was to borrow against its assets to increase dividend payments to shareholders.

By 2017, when Macquarie sold its last stake, the pattern of debt remained, and the rate of accruing debt continued on the same trajectory.

Macquarie and its co-investors made their position clear from the start, hiking dividends in the first year of their operations, 2007, to £656m when profits were a fraction of that at £241m.

Over their 11 years of control, Macquarie and its co-investors paid out £2.8bn to shareholders, which is two-fifths of the total £7bn in dividends that Thames Water has paid between 1990 and 2022. The average yearly dividends paid during the Macquarie period were five times higher than those paid after it sold its final stake in 2017.

The consortium that took over ownership of Thames Water in 2017 has not taken a dividend since, but the company has paid internal dividends – including £37m in the year to 31 March 2022.

Weston inherits a firm seeking £2.5bn of equity from shareholders to turn itself around, on top of £750m already pledged. While Ofwat is investigating Thames Water over the £37.5m of dividends it paid to its parent company, Kemble Water Limited, in the six months to 30 September, which could have meant the company breached the terms of its licence.

The regulator’s chief executive, David Black, told MPs this week that Ofwat was prepared to take action which could lead to the company’s administration. “We have never seen a water company fail but that remains a possibility,” he said. “If we have to take steps that lead to the failure of the parent company then we are prepared to do so.”

However, the odds are Thames Water won’t see 2024 out before it falls back into Public ownership. Milked dry by the greedy locust who continue to plunder our commons.

I have warned for years that privatisation would end in disaster. All the duplicitous promises of efficiency, the slick advertising campaigns, the robotic assurances that greedy foreign investors could be trusted with our essential utilities. Well, here is the reality. A once proud public utility, built up by generations of workers and engineers, flung to the jackals and sinking ever deeper into dysfunction, disgrace and debt.

Privatised Profits, Socialised Losses: Thames Water Debacle Exposes Failed Model

We all know where this will end up…

As Thames Water teeters on the brink of effective nationalisation, its unravelling finances spotlight the disastrous endgame of Britain’s water privatisation push. Nearly £20 billion in debt, dependent on continuous bailouts, Thames has become an overleveraged husk ripe for taxpayer rescue – precisely as profits have gushed abroad for years into the coffers of foreign investors.

The cycle exemplifies the cynical opportunism behind the UK’s privatisation mania since the 1980s. Private interests swoop in to seize public assets built up over generations, extracting as much wealth as fast as possible while allowing infrastructure and services to decay. Then when crisis hits, suddenly it’s the public left footing the bill – socialised losses after privatised profits.

Thames’ management admitted they lack funds even to repay a loan due next April, warning that nationalisation could leave taxpayers facing a multi-billion pound liability. Yet they simultaneously demand approval for 40% above-inflation bill increases over eight years, holding ratepayers hostage to finance their financial engineering. Regulators must call their bluff.

They don’t care about the quality of British water, they don’t drink it!

LH

This debacle was engineered by design. The Tory zeal to sell off water companies to the highest bidder ensured foreign investors now dominate through opaque ownership structures maximizing debt and dividends. Corporations like Thames abdicated duty of care over rivers and watersheds in pursuit of shareholder value. They don’t care about the quality of British water, they don’t drink it.

The results have been no less than catastrophic – criminal negligence and environmental despoliation while households struggle with soaring charges. The very notion of water as a human right has been callously betrayed.

It is time to chart a new course – one that reclaims water from the clutches of rent-seeking capital to resituate it as an essential public good held in common. The systematic failure of privatisation demands we explore public and community models grounded in values of equity, sustainability and democratic accountability. Profit must no longer eclipse basic decency in determining access to resources that give life itself.

If greed-driven private ownership cannot safeguard waterways for communities and future generations, we must. Through sustained civic pressure and visionary policies, the tide can turn. But we cannot wait – the next corporate collapse lurks just beyond the horizon, in fact it’s already here.

When will this squalid circus come crashing down? Even now, the shite hawk’s circle, ready to seize Thames’s juicy assets for a song if things unravel, while the public gets to inherit the debt. But you can be sure Mr Weston’s package will stay handsomely intact as customers and taxpayers absorb the losses.

So down the plughole rushes our water, our money, our heritage. Is there nobody left in this poor country with the courage to turn off the tap before it empties completely? I fear that day is not far off.

By Paul Knaggs. We could really do with your help. Please consider donating to Labour Heartlands. See below…

Support Independent Journalism Today

Our unwavering dedication is to provide you with unbiased news, diverse perspectives, and insightful opinions. We're on a mission to ensure that those in positions of power are held accountable for their actions, but we can't do it alone. Labour Heartlands is primarily funded by me, Paul Knaggs, and by the generous contributions of readers like you. Your donations keep us going and help us uphold the principles of independent journalism. Join us in our quest for truth, transparency, and accountability – donate today and be a part of our mission!

Like everyone else, we're facing challenges, and we need your help to stay online and continue providing crucial journalism. Every contribution, no matter how small, goes a long way in helping us thrive. By becoming one of our donors, you become a vital part of our mission to uncover the truth and uphold the values of democracy.

While we maintain our independence from political affiliations, we stand united against corruption, injustice, and the erosion of free speech, truth, and democracy. We believe in the power of accurate information in a democracy, and we consider facts non-negotiable.

Your support, no matter the amount, can make a significant impact. Together, we can make a difference and continue our journey toward a more informed and just society.

Thank you for supporting Labour Heartlands