Probably one of the most common right-wing arguments against social welfare spending is that it constitutes “redistribution of wealth” or “sharing the wealth,” and is thus a road to socialism. Indeed, “socialism” is often defined by these reactionaries as the redistribution of wealth, which is seen as the ultimate evil because it leads to socialism, which is evil, and it’s evil because it entails the redistribution of wealth – you get the idea.

There are a few notable problems with this. First, socialism is far more than simply the “redistribution of wealth.” Second, redistribution of wealth happens all the time under capitalism, yet strangely the right-wing only complains when some hypothetical redistribution favours the working class as opposed to the capitalists.

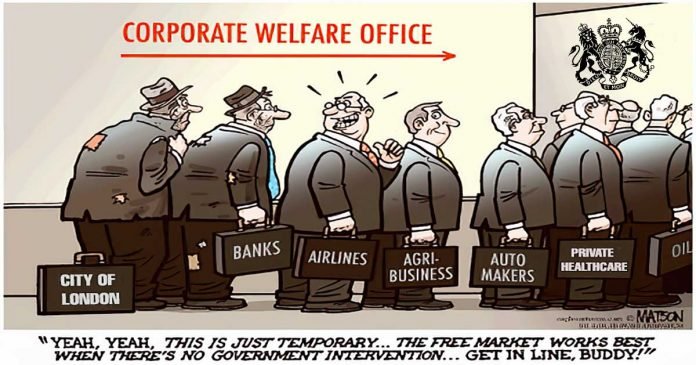

The massive redistribution of wealth that is carried out in times of crisis, such as the Banking Collapse and now the Covid-19 pandemic is seeing billions in Taxpayers money being transferred to the private sector in the form of bailouts. The only question is how much more Austerity can the establishment impose on the masses. Not is it fair and does it work?

A study from a US progressive think tank has found that while the coronavirus pandemic was exploding across the US, the country’s billionaires saw their combined wealth surge by $282bn – with eight of them netting more than $1bn each since the beginning of the year.

According to the Institute for Policy Studies’s “Billionaire Bonanza 2020”, while the total number of billionaires around the world has dropped slightly, the US contingent enjoyed a dramatic wealth increase between 18 March and 10 April even as the markets went haywire and tens of millions of Americans filed for unemployment.

Beyond the overall figures, the report also singles out several individual billionaires as what it calls “pandemic profiteers”. Among them is Elon Musk, who has profited to the tune of around $5bn from Tesla and SpaceX’s involvement in developing and producing new ventilators.

At the very top of the scale is Amazon CEO Jeff Bezos – already the world’s richest person – who the institute says has seen his wealth grow by $25bn since 1 January this year, an increase the institute says is “unprecedented in modern financial history” and larger than the GDP of Honduras.

And to the extent billionaires have initially taken hits to their wealth thanks to the pandemic’s economic fallout, they seem to be mostly recovering even as the crisis continues.

The coronavirus crisis is likely to cost the U.K. Government £246bn this year, a think tank has predicted.

The UK’s coronavirus wage subsidy scheme alone may cost taxpayers £40 billion as more companies take it up than expected.

The Resolution Foundation think tank says the Job Retention Scheme could result in a third of private sector employees – between 8million and 11million people – being “furloughed” on up to 80% pay.

The report from the Centre for Policy Studies (CPS) reveals borrowing could hit £300bn this year, double the UK’s current level of healthcare spending.

The think tank estimates that a three-month lockdown followed by three months of looser restrictions will cost £127bn in direct bailout costs and £119bn in indirect costs such as lower tax revenue

The crisis itself is already exacerbating economic inequalities. At first sight, the U.K. government’s income support schemes might look as though they will help to redress this. In reality, they will achieve almost exactly the opposite. It’s been widely noted that many people remain excluded from the safety net, but the problem goes deeper than this. Where is all this money coming from – and where is it ultimately going?

The answer lies principally in a massive expansion of debt. Wage support is being funded by large-scale public borrowing of the kind we were told was unaffordable just a few months ago (although this is now being supplemented by direct financing with newly created money from the Bank of England). Yes, this could usher in a new era of state intervention – but it could just as easily herald a new era of austerity.

But for the right-wing this is the cost of saving capitalism and the mantra “we’re all in this together” once again follows statements relating to the massive bailouts given to big business.

To understand why socialism does not equate to redistribution of the wealth, we must first ask what distribution means.

Distribution in economics refers to the manner in which total output or wealth is distributed among individual people or various factors of production. For the purposes of this article, distribution among individuals is the most relevant.

Human beings in a given society produce wealth, in various forms, and this wealth is distributed among the members of society via various institutions, laws and mechanisms. However, to speak about how and to whom wealth is distributed inevitably leads to asking questions as to who produced that wealth in the first place. Speaking about distribution without mentioning production is simply useless. Thus we must go deeper.

In the capitalist mode of production, commodities are produced socially by workers. Even commodities which are still produced by skilled individuals, such as works of art, require inputs which are produced socially. A single artist may create a painting, but who manufactured the paint, the canvas or the brushes? One of the peculiarities of capitalism is that the socialisation of production, meaning commodities are produced socially by many people, leads to a world in which the commodities we buy appear disconnected from the people who produced them. We look on a shelf and see an MP3 player from “Sony,” a large corporation. We understand that Sony made this product,’ but who is Sony anyway? If we buy the MP3 player, it appears as though we have engaged in a monetary transaction with the retailer and the seemingly faceless Sony Corporation. There has been an exchange; money for an MP3 player which you now own.

What is not so apparent is the relationship between you and the people that actually produced the MP3 player. In fact this would include not only workers in Sony’s manufacturing plants, but also those workers who build the individual components, who mine or extract the resources necessary for their production, and of course those who transport all these commodities, to name a few. This is in stark contrast to past modes of production, where the few material commodities which existed were often supplied by skilled workers whom everyone in the community knew. When you bought something from a blacksmith, for example, you knew that blacksmith and understood that you were buying the products of his labor. This is not the case under capitalism.

So here we have one MP3 player out of tens of millions manufactured and sold worldwide. And of course Sony and its competitors make not only MP3 players but all kinds of products, the sales of which lead to the creation of wealth in money form. So how is that wealth distributed? If we go back to our pre-capitalist society where skilled craftsmen produced certain commodities, the answer is simple. The master craftsman, owning his own tools and having performed the labor necessary to produce the commodity, appropriates whatever value he can exchange for it. He appropriates that value not simply because he did the work or he owns the tools, but because he also owns any commodity he produces. Now think about all those workers, in several different countries, who produce MP3 players, and think about the amount of money the sales of these products earn. To whom will the large portion of that money, including profit, go?

Under capitalism, private ownership of the means of production such as factories, machines and raw materials is what determines the ownership of not only the commodities produced via those means of production, but also the proceeds of the sales of the commodities. In other words, shareholders and proprietors appropriate commodities they did not produce, and pocket the profit from their sales.

What about the workers’ compensation? How is that determined? Another peculiarity of capitalism is that one’s wages are generally not linked with productivity. Most People are aware that many of their products are produced by workers in foreign countries for extremely low wages. In other words, these people work hard, and are extremely productive, yet are compensated with what amounts to crumbs from the table.

Once we factor production into the equation, we can now examine distribution. Under capitalism, the majority of the means of production are owned privately by a minority of people. The majority of people are deprived of their own means of production, meaning they do not have the means to support themselves either directly via the land or by the production of commodities which they can sell for money. They possess only one commodity – their capacity to do labor. The capitalist has a huge pool of labor to choose from; as workers are ultimately compelled by the threat of homelessness and starvation, there will always be someone desperate enough to accept a lower wage. If they don’t find such people in their own country, they can move their production operations elsewhere. Since they own capital, and means of production, the deck is stacked in their favour. The workers produce wealth, but it is distributed primarily to the capitalists. This is true whether we look at the world as a whole, or the wealth of one particular country.

In the case of the United kingdom, productivity rose sharply along with the introduction of computer and other digital technology in the 1970s, creating a massive amount of wealth. Prior to this point in history, British’ real wages rose steadily alongside productivity. Afterwards, distribution changed; real wages stagnated or even fell, People started working harder and longer for less pay, while at the same time Bosses and owners started appropriating a vastly larger share of the wealth. That is to say, the wealth they did not produce in the first place. Thanks to this process, the U.K. has an income inequality ranking on par with several developing nations.

So what does this all mean? Simply, it means that redistribution of wealth, from the producers to those who do not work, occurs under capitalism.

Of course, when forced to admit to this, the right-wing will raise various objections in an attempt to distract from the obvious exploitation that is occurring here. BBC News, and the rest of the right-wing noise machine has recently started referring to capitalists as “job creators,” the implication being that these multi-millionaires and billionaires deserve their massive wealth simply because they “create jobs,” even if they personally did not produce anything.

This argument fails right out of the gate. For one thing, “jobs” are “created” out of necessity. If any of us found ourselves dropped onto an island somewhere, we would go about laboring to produce the means for our survival without the intervention of another party to “create jobs.” Next, we could apply this term “job creator” to all kinds of individuals throughout history, including slave-owners, feudal lords, pimps and Nazi concentration camp commanders. If one chooses to limit the discussion to modern industrial nations, one might find it difficult indeed to explain how socialist nations such as the U.S.S.R. or Albania managed to have full employment without the existence of “entrepreneurs” to create jobs. If lower taxes and higher profits inspire “entrepreneurs” to create jobs, one has to wonder why the official unemployment rate is over 9% at the time of this writing. As an attempt to justify the massive distribution of wealth to those who don’t produce it, the “job creators” argument falls flat on its face.

Other justifications abound. For example, entrepreneurs “take risks,” and thus deserve their massive compensation. This fails for a number of reasons, but the most obvious being that human labor, not risk, is what creates wealth. Risk is not a commodity, it does not have a price, and we do not buy and sell risk. Corporations and investors actually prefer to avoid risk as much as possible, often spending a great deal of money to minimise their risks. Does a company which goes to great lengths to avoid risks necessarily end up poorer than those that don’t? Usually this is not the case; wise investments pay off. If one wants to get rich with risk, go to Vegas.

Lastly, another justification is that investors, bankers, top managers, etc., earn their massive compensation with their own “hard work,” not only in business but in university when they were younger. This argument fails just as hard as the others. For one thing, we know that “hard work” and productivity do not determine wages. If they did, we would have no explanation for the past thirty years of stagnant real wages in the U.K., for one. Second, we have no way of knowing exactly how hard these people “worked” through university, and this is irrelevant because these companies are selling commodities, not their “hard work” in university. Lastly, while all these individuals may perform daily tasks, which may indeed be stressful or require great intelligence or talent, it does not mean that this work is actually productive, that is to say that it produces wealth. Lastly, investors and bankers are entitled to profits merely by their ownership of stocks, bonds, loans, etc; they will derive wealth from these assets regardless of what they do or do not do.

So if “redistribution of wealth” inevitably goes on under capitalism, and socialism isn’t necessarily the redistribution of wealth, what then, is socialism?

Socialism, in its most basic form, entails not the redistribution of wealth, but the expropriation, that is seizure, of the means of production by the working class. If capitalism is a system where production is socialised, meaning commodities are produced socially by many people, while the products and the value from their sales are privatised, socialism merely balances out the equation. That is to say that production is still socialised, but the appropriation of the value that is produced, including surplus value, is also socialised. Thus society benefits as a whole.

Why this system is better than capitalism is a matter for another article, but what the reader can conclude from this is the following: “redistribution of wealth” occurs under capitalism, and when it results in massive inequality, standards of living and society suffer. Socialism is something far more comprehensive than a simple redistribution of wealth.

Help Us Sustain Ad-Free Journalism

Sorry, I Need To Put Out the Begging Bowl

Independent Journalism Needs You

Our unwavering dedication is to provide you with unbiased news, diverse perspectives, and insightful opinions. We're on a mission to ensure that those in positions of power are held accountable for their actions, but we can't do it alone. Labour Heartlands is primarily funded by me, Paul Knaggs, and by the generous contributions of readers like you. Your donations keep us going and help us uphold the principles of independent journalism. Join us in our quest for truth, transparency, and accountability – donate today and be a part of our mission!

Like everyone else, we're facing challenges, and we need your help to stay online and continue providing crucial journalism. Every contribution, no matter how small, goes a long way in helping us thrive. By becoming one of our donors, you become a vital part of our mission to uncover the truth and uphold the values of democracy.

While we maintain our independence from political affiliations, we stand united against corruption, injustice, and the erosion of free speech, truth, and democracy. We believe in the power of accurate information in a democracy, and we consider facts non-negotiable.

Your support, no matter the amount, can make a significant impact. Together, we can make a difference and continue our journey toward a more informed and just society.

Thank you for supporting Labour Heartlands