Labour’s Two-Child Cap: A Stark Choice in a Nation of Plenty

Beneath the veneer of political discourse in Britain lies a stark reality: the supposed ideological divide between Labour and the Conservatives has eroded into a mere façade. For over a decade, Labour vociferously condemned Tory austerity measures, decrying their devastating impact on society’s most vulnerable. Yet, as power shifts, we witness not a red revolution but a Red Tory resurgence under Keir Starmer’s stewardship.

This metamorphosis of Labour into a pale imitation of its conservative counterpart exposes a fundamental truth: how a government allocates resources is not a matter of necessity, but of choice. Every pound spent, every policy implemented, every social program continued or cut – these are deliberate decisions that reflect priorities and values.

Take, for instance, the two-child cap – a policy that condemns 1.6 million of our poorest children to hunger. Labour’s decision to maintain this draconian measure while simultaneously pledging funds for a US proxy war in Ukraine lays bare the hollowness of claims that there’s “no money” for social welfare. It’s not a question of available resources, but of where we choose to direct them.

The oft-repeated mantra of scarcity crumbles when we examine the true nature of money creation in a sovereign state like the UK. As a nation that issues its own currency, we possess far more fiscal flexibility than politicians would have us believe. The real constraint is not a lack of funds, but a lack of political courage to prioritise the needs of the many over the desires of the few.

In “Magic Money Trees: Truth, Lies, and Deception,” we peel back the layers of economic mythology to reveal the mechanisms of money creation and the choices that shape our fiscal reality. We challenge the fallacies underlying austerity policies and expose the notion that fiscal responsibility must come at the cost of social welfare for the sham it truly is.

As we embark on this journey of economic enlightenment, let us recall Tony Benn’s poignant observation: “If we can find the money to kill people, we can find the money to help people.” It’s time to question the narratives that have shaped our understanding of economics and demand a system that truly serves the interests of all citizens.

The article that follows will unravel the mysteries of the “magic money trees” and illuminate the path towards a more equitable and prosperous society. The truth, as we shall discover, is far more empowering than the fictions we’ve been sold. It’s time to recognise that in the realm of government spending, necessity is often just another word for choice.

Magic Money Trees. Truth Lies and Deception.

“If we can find the money to kill people, we can find the money to help people.”

― Tony Benn

Benn was right to ask such a question as many often do.

The fact is when it comes to lining the pockets of the military-industrial complex, bailing out the financial elites, or indeed handed out public funds like confectioneries from a sweet shop to Tory friends and family as they did during Covid via their VIP WhatsApp groups, then it seems the treasuries coffers are always full.

But when it comes to providing a living wage to those toiling on the frontlines – the nurses, junior doctors, teachers, and civic workforces holding the fraying fabric of the nation together? Suddenly the exchequer runs as dry as the Sahara.

We are constantly told that money is scarce, and while fiscal responsibility is important, this narrative falls apart when both Labour and the Tories are adamant about funding the US proxy war in Ukraine with £3 billion a year. They also plan to increase our total funding for NATO to 2.5% of GDP per annum, amounting to around £87.1 billion, to fight in the Forever Wars.

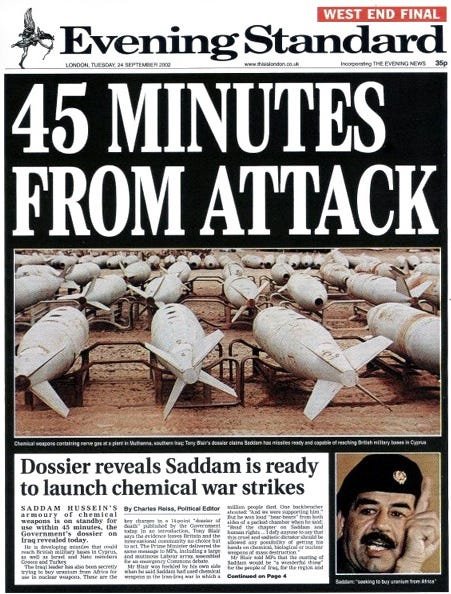

These Forever Wars are always marketed as existential threats, like ’45 minutes to save the world.’ The claim that Russia is poised to invade the rest of Europe collapses under scrutiny, especially when considering they didn’t act while NATO was engaged in a 20-year war in Afghanistan and the Middle East. It’s a reminder that those who fail to question the prevailing narrative often miss the broader picture.

Abolishing the two child cap would cost £1.3bn a year but would lift 250,000 children out of poverty, and a further 850,000 would be in less deep poverty, according to campaigners. The End Child Poverty coalition says removing the cap would be the most cost-effective way of reducing the number of children living in poverty.

It is a political choice not to…

Given these realities, why do we falter in investing in essential services and institutions needed for a thriving 21st-century economy? Why don’t we simply remove the constraints of the debt ceiling, as is done with the U.S. budget?

These questions reveal a complex interplay of political priorities, economic ideologies, and the exercise of power.

Of course, a government’s decision-making process is heavily influenced by political considerations that often reflects choices that prioritise certain sectors or initiatives over others, mainly the private sector over public needs the main thrust of the Neoliberal consensus.

This contradiction exposes the inherent cynicism at the core of the austerity doctrinaires’ rhetoric. Their invocations of sound money management and tightened belts are mere pretexts, linguistic chaff to obscure an agenda of perpetuating injustice by preserving an unjust status quo. In truth, a government’s fiscal priorities are dictated not by some static scarcity, but by a revolving slate of political choices that consciously elevate for the few at the expense of the many.

They continue to peddle the misleading claim that balancing the government’s budget is akin to balancing a household’s finances. This simplistic analogy fails to account for the complexities and broader economic impacts of fiscal policy decisions that affect millions of lives.

Coupled with this flawed metaphor is the resurgence of trickle-down economic theory – the debunked notion that enriching the wealthy will inevitably benefit all levels of society. Despite repeated evidence undermining its validity, this ideology persists, fueling policies that exacerbate wealth inequality.

Such arguments represent a disingenuous attempt to frame austerity measures and regressive economic policies as exercises in prudent financial management. However, beneath the veneer of fiscal responsibility lies an agenda that primarily benefits the affluent at the expense of the broader population.

The truth is that government budgeting and economic policymaking are intricate endeavors with far-reaching consequences. Reducing them to simplistic analogies or discredited theories disregards the nuances involved and overlooks the real-world impacts on everyday people.

As the new Labour government continue to argue for austerity measures and limited spending, invoking the notion of scarce resources, for the people more so than ever it becomes imperative to scrutinise the underlying motives and examine whether such claims hold true.

Mark Blyth on Austerity.

Mark Blyth Quote: Spirit Level.

The kicker is that those social services that used to be state funded, will be sold off to the privatised free market.

Why should we be forced to sell off our safety net to those who crashed the economy in the first place, Is this fair? The free market very rarely creates genuine price realisation, just Ponzi growth created by monopolisation, funded by toxic banks, resulting in very little infrastructure investment.

Privatised energy and transport markets are a prime example of this here in the UK……we get completely ripped off.

Mark Blyth

It is worth noting that governments possess the ability to shape fiscal policies and make financial decisions that align with their priorities and politics.

The argument that there is a scarcity of funds should be met with scepticism, as it may conveniently serve to advance particular agendas or perpetuate the status quo.

Regarding wage increases for vital public service workers, the assertion that there is insufficient money begs the question of where societal priorities truly lie. It is a matter of choice and political will to allocate resources towards the remuneration and support of those who tirelessly serve the public.

Similarly, investing in the agencies and bodies necessary for a vibrant and prosperous economy should be seen as an investment in the nation’s future. The claim that funds are lacking obscures the potential benefits of such investments, both in terms of economic growth and societal well-being.

Quantitative easing…

While jail time remained conspicuously off the table, the coffers have certainly not run dry for those who orchestrated the financial crash. Indeed, the very architects of economic calamity have found themselves awash in a sea of public largesse, their pockets lined with the fruits of taxpayer-funded bailouts and quantitative easing.

With a bate and switch, we’ve witnessed a perverse form of socialism for the rich and rugged individualism for the poor. The banks, those towering bastions of free-market capitalism, were deemed “too big to fail” and promptly resuscitated with public funds. Meanwhile, the average citizen was left to weather the storm of austerity, told to tighten their belts while watching the financial elite loosen theirs.

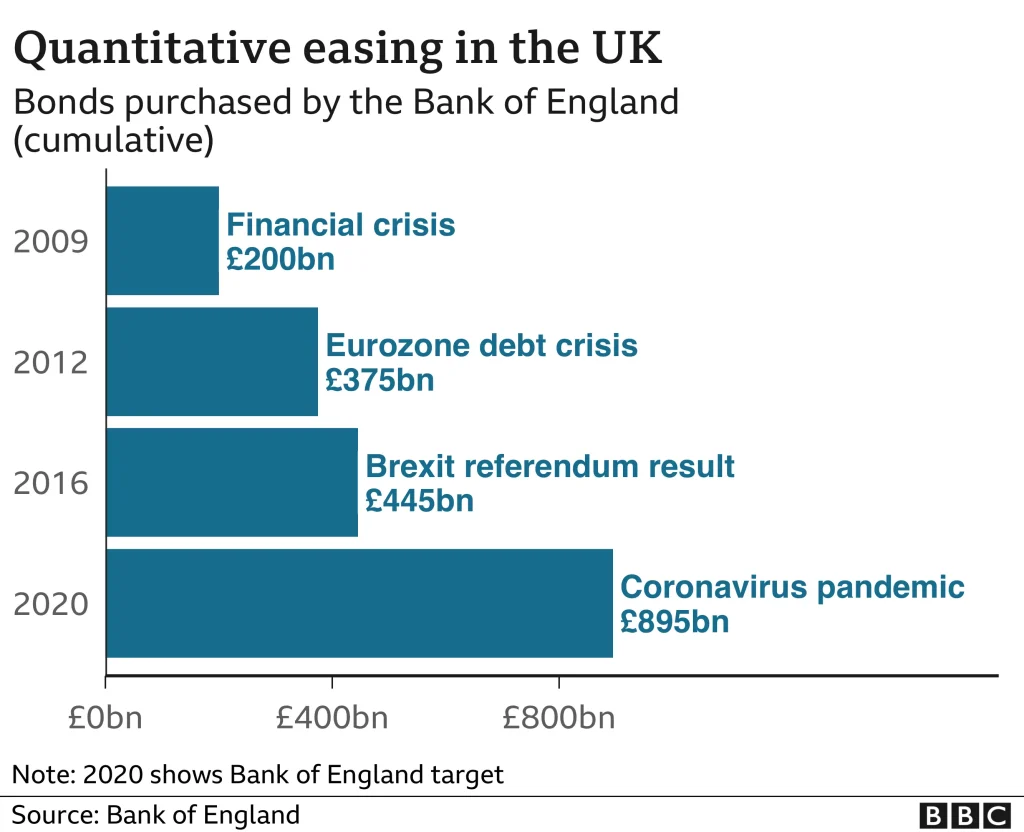

The Bank of England, in its infinite wisdom, launched round after round of quantitative easing – a euphemism for printing money if ever there was one. Starting in 2009, ostensibly to save us from the jaws of financial ruin, this monetary magic trick continued through the eurozone debt crisis, Brexit, and the coronavirus pandemic. Each time, billions were conjured into existence, not to rebuild our crumbling infrastructure or bolster our beleaguered public services, but to prop up financial markets and inflate asset prices.

This fiscal favouritism has created a two-tiered recovery: a bull market for the wealthy and a bear market for everyone else. As stock portfolios swelled and property prices soared, wages stagnated and public services withered on the vine. It’s a stark reminder that when it comes to finding money, it’s not a question of availability, but of political will and priorities.

The contrast couldn’t be more glaring. We’re told there’s no money for nurses’ pay rises or to feed hungry children, yet the spigots of public funds flow freely when it’s time to bail out banks or subsidise corporate interests. It’s a damning indictment of a system that privatizes profits and socializes losses, all while preaching the gospel of fiscal restraint to those least able to bear its burden.

The first QE programme in the UK was launched in 2009 when the financial crisis was threatening the economy, unemployment was rising and the stock markets were in freefall.

The Bank subsequently launched new rounds of QE after the eurozone debt crisis, the Brexit referendum and the coronavirus pandemic.

As for the debt ceiling, the United States has employed a practice of raising it to ensure the functioning of government operations. The Treasury Department reached its debt ceiling of $31.4 trillion in January 2023, and after months of debate, lawmakers voted in June of that year to suspend the ceiling until January 2025.

The question arises as to why similar flexibility and adaptability cannot be embraced in other contexts. It is a matter of policy and political inclination to reassess and recalibrate our approach to debt, particularly when the circumstances demand it.

In essence, we must challenge the government narrative when it portrays a scarcity of funds. By scrutinising political choices, questioning priorities, and demanding accountability, we can aspire to build a society where resources are allocated equitably and responsibly.

The potential to find the money to address pressing social needs and invest in our collective future exists. It is a matter of political courage, vision, and a genuine commitment to the well-being of the people.

It is the political will of both major parties to make this happen that doesn’t exist.

So how is money really made?

And here we are, the enigmatic concept of the “magic money tree.” Allow me to shed some light on the intricate process of money creation within a sovereign country like the United Kingdom. While it may not involve mystical foliage, it does possess a certain air of intrigue.

In a nutshell, money creation in the UK occurs through a combination of actions by both the central bank, which is the Bank of England in this case, and private commercial banks. This process revolves around the creation of new money supply in the form of digital currency.

Let us start with the central bank…

The Bank of England, as the institution entrusted with maintaining monetary stability, has the authority to create money. It does so through a mechanism known as “quantitative easing” (QE).

In times of economic need or crisis, the central bank may decide to inject new money into the economy by purchasing financial assets, such as government bonds or corporate securities, from commercial banks or other financial institutions. These transactions are typically conducted electronically, resulting in the creation of new money in the accounts held by those institutions.

The purpose of such quantitative easing is to stimulate economic activity, encourage lending, and maintain price stability. By injecting money into the financial system, the central bank aims to lower interest rates, increase the availability of credit, and boost overall liquidity.

Now, let us turn our attention to commercial banks, the primary actors in money creation. When individuals, businesses, or other entities seek loans from commercial banks, these banks have the power to create new money in the process.

When a bank approves a loan, it simply credits the borrower’s account with the agreed-upon amount, effectively creating new money out of thin air. This newly created money then enters circulation and can be used for various purposes, such as investments, purchases, or debt repayments.

It is important to note that this money creation by commercial banks is not unlimited or unchecked. Banks are required to adhere to regulations and maintain sufficient reserves to support their lending activities.

The Bank of England, as the regulatory authority, sets guidelines and safeguards to ensure that banks maintain a sound financial position and mitigate risks associated with excessive money creation.

So, while the notion of a “magic money tree” may be more metaphorical than literal, the process of money creation in the UK involves a delicate interplay between the central bank’s actions through quantitative easing and the lending activities of commercial banks. This dynamic relationship shapes the money supply and plays a pivotal role in the functioning of the economy.

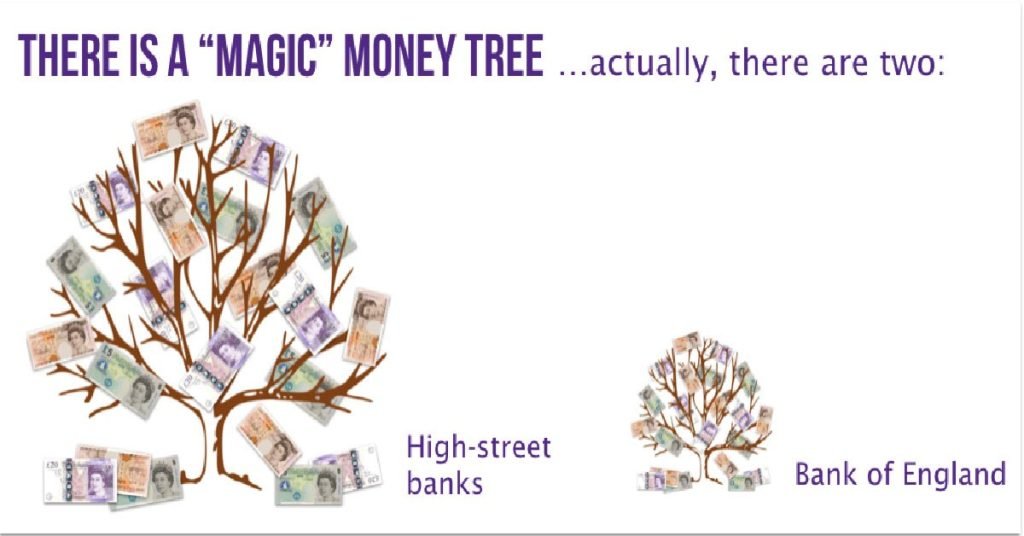

The Magic Money Tree

In fact, Professor Emeritus Mary Mellor, from the University of Northumbria explains how there are two Magic money trees and how money is created…

That’s right there are two magic money trees. Both the state and the banks can create money out of thin air.

States do this by having budgets. Despite the myths that have been told time and time again, states are NOT households – they run armies and banks and schools and police forces and so on. They allocate expenditure in expectation of getting an equivalent amount of money back through taxation. There is no direct connection between public expenditure and public income. There is no state piggy bank or housekeeping allowance.

Despite the claim that states ‘printing’ money is automatically inflationary, this is not the case. What matters is the relationship between state income and expenditure and the condition of the wider economy. The skill is to balance the money created with the money recovered via taxation. In any case, public deficits can be a good thing. They put fresh money into the economy that is then free to circulate.

The other magic money tree is the banking sector. Banks do not simply look after the money in people’s bank accounts and “lend it out”, they actually create money out of thin air by creating new accounts or putting new money into existing accounts – with no democratic accountability.

The neoliberal era saw a massive increase in bank lending (student, consumer, mortgage, financial speculation) with banks becoming the major source of new money in modern economies. The magic money tree of the banks is far more destabilising than the magic money tree of the state. Unlike state magic money which can be created free of debt, bank magic money always has to be repaid with interest.

This creates the dilemma that the banks always want more money back than they lend out. Where does the extra money come from? Either extra loans constantly being taken out, or ‘leakage’ of debt free money from the state, that is public deficit. In fact, the use of public money was much more direct following the 2007-8 crisis.

‘Quantitative easing’ – a fancy term for new electronic money from central banks – put billions of pounds, dollars and euros into the banking sector to stave off collapse. This and other rescue measures did little to stimulate the core economy but made a small elite very rich.

So when we are told social welfare, education, housing, and health aren’t afforded because there is no magic money tree, that’s the lie! New money is constantly pouring into the hands of the already rich as they gamble and speculate. Ordinary people are burdened with debt as they try to keep their heads above water.

The right of states to directly fund public services (“people’s quantitative easing”), is denied. It is falsely claimed that all new money is ‘made’ by the market sector. This is not true, money is accumulated in the market. It can only be created by states or banks. The claim that all state income comes from taxing the private sector is also false. The public sector also pays taxes – much more reliably than the private sector.

Let us have no more myths about the lack of magic money trees. They do exist – what matters is who owns and controls them. And it should be all of us.

Indeed, to bring about meaningful change in our society, it is imperative that we reshape our perspectives on money and its utilisation. Money, in its essence, is a tool that can be wielded to shape the destiny of nations and the lives of individuals. By reevaluating our relationship with money and adopting a more holistic approach to its use, we can strive for a society that prioritises the well-being of its people and invests in the collective progress of the nation.

Simultaneously, investing in our country is vital for its long-term success. This encompasses infrastructure development, technological advancements, research and innovation, and sustainable practices. By directing resources towards these areas, we can create a solid foundation for a viable 21st-century economy that thrives in an ever-evolving global landscape.

Support Independent Journalism Today

Our unwavering dedication is to provide you with unbiased news, diverse perspectives, and insightful opinions. We're on a mission to ensure that those in positions of power are held accountable for their actions, but we can't do it alone. Labour Heartlands is primarily funded by me, Paul Knaggs, and by the generous contributions of readers like you. Your donations keep us going and help us uphold the principles of independent journalism. Join us in our quest for truth, transparency, and accountability – donate today and be a part of our mission!

Like everyone else, we're facing challenges, and we need your help to stay online and continue providing crucial journalism. Every contribution, no matter how small, goes a long way in helping us thrive. By becoming one of our donors, you become a vital part of our mission to uncover the truth and uphold the values of democracy.

While we maintain our independence from political affiliations, we stand united against corruption, injustice, and the erosion of free speech, truth, and democracy. We believe in the power of accurate information in a democracy, and we consider facts non-negotiable.

Your support, no matter the amount, can make a significant impact. Together, we can make a difference and continue our journey toward a more informed and just society.

Thank you for supporting Labour Heartlands