Labour’s candidate for Batley and Spen using 2017 Tory attack lines to explain why she won’t back a proper pay rise for nurses and teachers. saying:

“People are also sick of thinking there’s a magic money tree, there isn’t, so we’ve got to be clear about that.”

Again we see the economic illiteracy of the Labour Party unwilling to advance any other alternative than the status quo and that very out of date thinking of the economy being like a household budget.

Vote Leadbeater get TINA

“There is no alternative” (TINA) was a slogan often used by the Conservative British prime minister Margaret Thatcher.

The phrase was used to signify Thatcher’s claim that the market economy is the only system that works, and that debate about this is over. One critic characterised the meaning of the slogan as: “Globalised capitalism, so-called free markets and free trade were the best ways to build wealth, distribute services and grow a society’s economy.

In 2013, Prime Minister David Cameron resurrected the phrase, stating “If there was another way I would take it. But there is no alternative”—referring to austerity in the United Kingdom.

The magic money tree bears fruit only for the few.

Of course, there is no magic money tree when it comes to Nurses or Teachers pay, or even free school meals for that matter. However, the Bank of Englands printers worked overtime to create more wealth for the ‘few’ during this pandemic, turning millions into billions and those with billions “did extremely well” during the coronavirus pandemic, growing their already-huge fortunes to a record high of $10.2tn (£7.8tn).

A report by Swiss bank UBS found that billionaires increased their wealth by more than a quarter (27.5%) at the height of the crisis from April to July, just as millions of people around the world lost their jobs or were struggling to get by on government schemes

We understand full well how Magic money trees are used to create wealth for the rich. The magic of the money tree is in its ability to disappear when it comes to benefiting the many.

This government certainly found over £500b in a covid magic money tree. In the first year of the pandemic, from April 2020 to 2021, it borrowed £299bn, the highest figure since records began in 1946.

The government is expected to borrow less in the current year, April 2021 to 2022, though the figure could still be more than £200bn.

If an MP or candidate cannot answer the question of where does money come from they really should be looking for a new job.

The old-fashioned way of thinking suggests money is a social phenomenon, arising spontaneously as a matter of necessity to grease the wheels of trade. Governments, having no money of their own, levy taxes and in return protect property rights, organise the defence of the realm, and so on is strictly limited by how much money the government can collect in taxes, or borrow. But modern thinking and a few truths dispel that old-fashioned way of thinking.

All money comes from a magic tree, in the sense that money is spirited from thin air. There is no gold standard. Banks do not work to a money-multiplier model, where they extend loans as a multiple of the deposits they already hold. Money is created on faith alone, whether that is faith in ever-increasing housing prices or any other given investment.

This does not mean that creation is risk-free: any government could create too much and spawn hyper-inflation. Any commercial bank could create too much and generate over-indebtedness in the private economy, which is what has happened. But it does mean that money has no innate value, it is simply a marker of trust between a lender and a borrower.

So it is the ultimate democratic resource. The argument marshalled against social investment such as education, welfare and public services, that it is unaffordable because there is no magic money tree, is nonsensical. It all comes from the tree; the real question is, who is in charge of the tree?

By creating the myth that a countries budget runs like a household Margret Thatcher paved the way for austerity. The pretence that taxes pay for everything allowed for the pretence we need to sell off the family silver when times get tough. To trim the fat or run or households within its budget.

Ask the Greeks how that works, being forced to sell off the countries utilities and more to private hands in exchange for bailouts was just modern-day plundering.

If anyone tells you that austerity was essential, ask them if 100,000 deaths were necessary for an economic theory. Didn’t John Maynard Keynes debunk all of this in the 1930s?

Mark Blyth Quote: Spirit Level.

The kicker is that those social services that used to be state funded, will be sold off to the privatised free market.

Why should we be forced to sell off our safety net to those who crashed the economy in the first place, Is this fair? The free market very rarely creates genuine price realisation, just Ponzi growth created by monopolisation, funded by toxic banks, resulting in very little infrastructure investment.

Privatised energy and transport markets are a prime example of this here in the UK……we get completely ripped off.

Magic Money Trees. Truth Lies and Deception.

By Professor Emeritus Mary Mellor, from the University of Northumbria

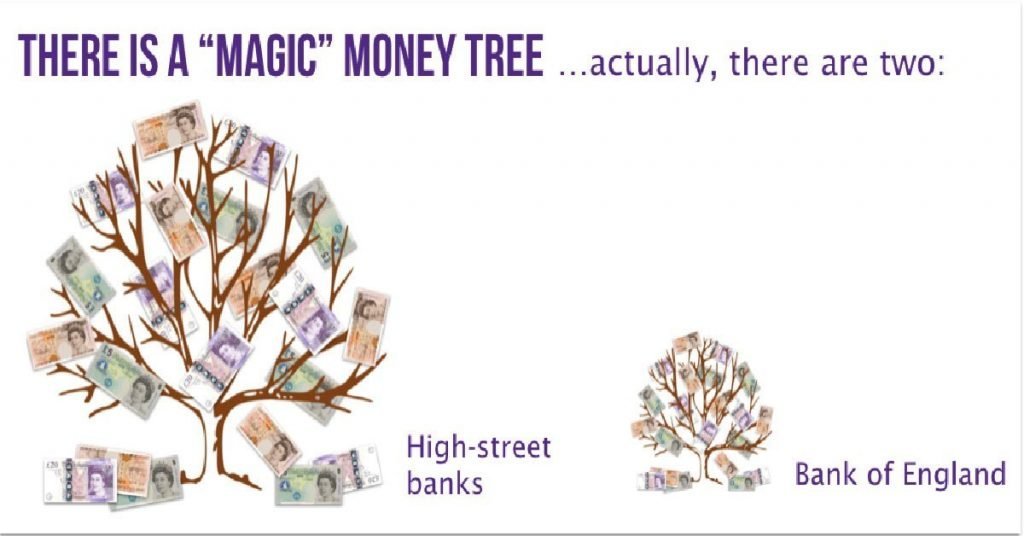

That’s right there are two magic money trees. Both the state and the banks can create money out of thin air.

States do this by having budgets. Despite the myths that have been told time and time again, states are NOT households – they run armies and banks and schools and police forces and so on. They allocate expenditure in expectation of getting an equivalent amount of money back through taxation. There is no direct connection between public expenditure and public income. There is no state piggy bank or house-keeping allowance.

Despite the claim that states ‘printing’ money is automatically inflationary, this is not the case. What matters is the relationship between state income and expenditure and the condition of the wider economy. The skill is to balance the money created with the money recovered via taxation. In any case, public deficits can be a good thing. They put fresh money into the economy that is then free to circulate.

The other magic money tree is the banking sector. Banks do not simply look after the money in people’s bank accounts and “lend it out”, they actually create money out of thin air by creating new accounts or putting new money into existing accounts – with no democratic accountability.

The neoliberal era saw a massive increase in bank lending (student, consumer, mortgage, financial speculation) with banks becoming the major source of new money in modern economies. The magic money tree of the banks is far more de-stabilising than the magic money tree of the state. Unlike state magic money which can be created free of debt, bank magic money always has to be repaid with interest.

This creates the dilemma that the banks always want more money back than they lend out. Where does the extra money come from? Either extra loans constantly being taken out, or ‘leakage’ of debt free money from the state, that is public deficit. In fact, the use of public money was much more direct following the 2007-8 crisis.

‘Quantitative easing’ – a fancy term for new electronic money from central banks – put billions of pounds, dollars and euros into the banking sector to stave off collapse. This and other rescue measures did little to stimulate the core economy but made a small elite very rich.

So when we are told social welfare, education, housing, health cannot be afforded because there is no magic money tree, this is a lie. New money is constantly pouring into the hands of the already rich as they gamble and speculate. Ordinary people are burdened with debt as they try to keep their heads above water.

The right of states to directly fund public services (“people’s quantitative easing”), is denied. It is falsely claimed that all new money is ‘made’ by the market sector. This is not true, money is accumulated in the market. It can only be created by states or banks. The claim that all state income comes from taxing the private sector is also false. The public sector also pays taxes – much more reliably than the private sector.

Let us have no more myths about the lack of magic money trees. They do exist – what matters is who owns and controls them. And it should be all of us.

Support Independent Journalism Today

Our unwavering dedication is to provide you with unbiased news, diverse perspectives, and insightful opinions. We're on a mission to ensure that those in positions of power are held accountable for their actions, but we can't do it alone. Labour Heartlands is primarily funded by me, Paul Knaggs, and by the generous contributions of readers like you. Your donations keep us going and help us uphold the principles of independent journalism. Join us in our quest for truth, transparency, and accountability – donate today and be a part of our mission!

Like everyone else, we're facing challenges, and we need your help to stay online and continue providing crucial journalism. Every contribution, no matter how small, goes a long way in helping us thrive. By becoming one of our donors, you become a vital part of our mission to uncover the truth and uphold the values of democracy.

While we maintain our independence from political affiliations, we stand united against corruption, injustice, and the erosion of free speech, truth, and democracy. We believe in the power of accurate information in a democracy, and we consider facts non-negotiable.

Your support, no matter the amount, can make a significant impact. Together, we can make a difference and continue our journey toward a more informed and just society.

Thank you for supporting Labour Heartlands