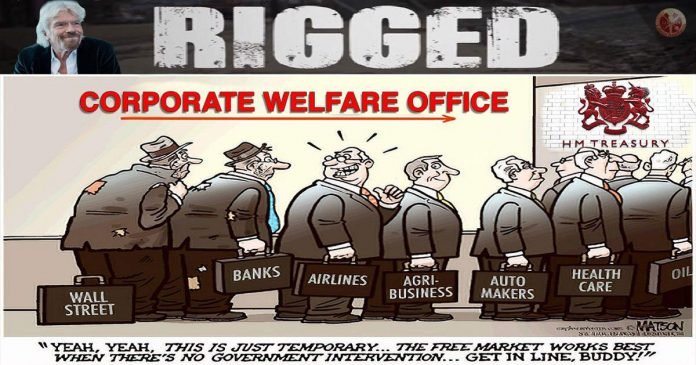

Martin Luther King Jr. once said “Free enterprise for the poor and socialism for the rich” and here we are again.

The coronavirus outbreak has derailed the global economy, governments and big business are looking at the tried and tested policy of bailouts. After all we must ensure the continuality of ‘the too big to fail lie’.

People on the left and right agree that government assistance is needed to avoid an economic catastrophe. On the individual level, many people already struggling in this austerity environment have lost jobs. Many more will. The best short term policy is to ensure people have access to welfare with a government targeted response as quickly as possible to those most in need. Cutting red tape now can and will save lives.

Its also a better policy to provide the fallback of furloughing of employees with assurances that company’s guarantee staff retention, The fact workers have a job to go back to will pay dividends with both peoples mental health and the much talked about ‘confidence’ the economy needs to thrive.

It’s going to cost a ton and comes with a huge price to pay down the road, but it’s also hard to argue that we don’t need it. That’s actually the easy part.

Much more needs to be done but just like the old mantra of “we are all in it together” it is doubtful the Tory’s will be inclusive, ensuring workers don’t go under will not be a priority.

On the corporate side, things get more complicated. People see closed shops, empty airports, empty restaurants and closed-down businesses. They know many industries are suffering. People also don’t want to throw our economy into a crisis. They will support a bailout, but if they later learn that the corporate world got anything that looks like a sweetheart deal out of this crisis, the political retribution will be overwhelming.

If you don’t pay your Taxes you can’t expect Taxpayers to bail you out!

Three European countries have moved to restrict companies that keep large sums of money overseas in tax havens from accessing stimulus funds.

Business Insider reported Thursday that France’s top finance minister said on a radio show that his goal was to prevent such companies from being eligible to receive any government stimulus.

“It goes without saying that if a company has its tax headquarters or subsidiaries in a tax haven, I want to say with great force, it will not be able to benefit from state financial aid,” said Bruno Le Maire.

“If your head office is located in a tax haven, it is obvious that you cannot benefit from public support,” he added

His announcement follows similar declarations from officials in Denmark and Poland.

Poland’s prime minister reportedly went a step further earlier this month, calling for an end to all tax havens, according to the news outlet: “end tax havens, which are the bane of modern economies.”

Denmark has told companies that they will not be eligible for bailout funds to help them through the coronavirus pandemic if they are registered in tax havens, prompting calls for other countries, including the UK, to attach similar strings to their own financial support packages.

The Danish government also said companies that access government support must not use profits to buy back shares or pay dividends to shareholders in 2020 or 2021. Earlier in April, Poland said its bailout funds would only be available to companies that pay tax in the country.

The moves have reignited debate over tax avoidance and come as Sir Richard Branson faced criticism after asking the UK government to bail out Virgin Atlantic with a £500m loan.

The free market, sink or swim!

No body says it better than Marina Hyde who described Richard Branson’s bailout plea as shameless. She goes on to say “Richard Branson is playing a particularly idiosyncratic game of Monopoly. He would like to mortgage his private Caribbean island. In return, you, the taxpayer, have to buy him Mayfair and Park Lane, all the greens, all the yellows, all the reds, and stick a hotel on every one of them. Also, if Richard lands on Super Tax or Income Tax he doesn’t pay them. And if he gets the Community Chest saying “pay hospital fees”, he refuses and sues the hospital. The only bright side is that he no longer operates out of any of the stations.

But perhaps we’re getting ahead of ourselves. By way of a recap, the tycoon is seeking a reported £500m government bailout of his Virgin Atlantic airline, and has stated in a blogpost that he is willing to put Necker Island up as collateral to secure lending for his businesses.”

Sir Richard Branson is trying to convince the UK government to give his Virgin Atlantic airline a £500m bailout to help it survive the coronavirus pandemic and the economic fallout of the lockdown.

Virgin Australia, which is 10% owned by the billionaire’s Virgin Group, is also seeking a £700m bailout from the Australian government.

Are you really to big too fail or just holding the other guy back?

The big question is world Virgin Atlantic going down be such a loss or in the capitalist market would it just open up space for a better product, a vacuum for some other Branson to fill. Remember Freddie Laker?

Sir Frederick Alfred Laker was an English airline entrepreneur, best known for founding Laker Airways in 1966, which went bankrupt in 1982. Known as Freddie Laker, he was one of the first airline owners to adopt the “low cost / no-frills” airline business model that has since proven to be very successful worldwide with companies such as Norwegian Air, Ryanair, easyJet, AirAsia and WestJet.

Branson wont be the only Tax avoiding tycoon to come running to the Taxpayers for a bailout. This is the kind of socialism businesses love. You can hear them now making the argument “We’re all in it together” for the sake of the economy or whatever mantra the bought and paid for PR company come up with.

The UK should adopt hard and set rules on how Taxpayers money is spent on bailouts the minimum requirement being the companies pay their taxes in the UK.

The Danish system will almost certainly have to use the EU’s corporate tax avoidance blacklist, which does not include some of the worst-offending countries within the EU.

The list was strengthened last year with the addition of the Cayman Islands, a key financial secrecy jurisdiction, but it is generally considered weak. EU nations, including the Netherlands, Ireland, and Luxembourg, which facilitate billions of euros of tax avoidance every year, are not on it, nor are Switzerland or most of the overseas territories and crown dependencies that make up the UK’s network of tax havens, including BVI, Jersey and Guernsey.

There is a petition to ‘Ensure Sir Richard Branson sells private assets before being bailed out by the government.’ if you agree and wish to sign here is the link.

Support Independent Journalism Today

Our unwavering dedication is to provide you with unbiased news, diverse perspectives, and insightful opinions. We're on a mission to ensure that those in positions of power are held accountable for their actions, but we can't do it alone. Labour Heartlands is primarily funded by me, Paul Knaggs, and by the generous contributions of readers like you. Your donations keep us going and help us uphold the principles of independent journalism. Join us in our quest for truth, transparency, and accountability – donate today and be a part of our mission!

Like everyone else, we're facing challenges, and we need your help to stay online and continue providing crucial journalism. Every contribution, no matter how small, goes a long way in helping us thrive. By becoming one of our donors, you become a vital part of our mission to uncover the truth and uphold the values of democracy.

While we maintain our independence from political affiliations, we stand united against corruption, injustice, and the erosion of free speech, truth, and democracy. We believe in the power of accurate information in a democracy, and we consider facts non-negotiable.

Your support, no matter the amount, can make a significant impact. Together, we can make a difference and continue our journey toward a more informed and just society.

Thank you for supporting Labour Heartlands