Secrets and Fries: How McDonald´s abuses the UK tax regime to dodge its global taxes

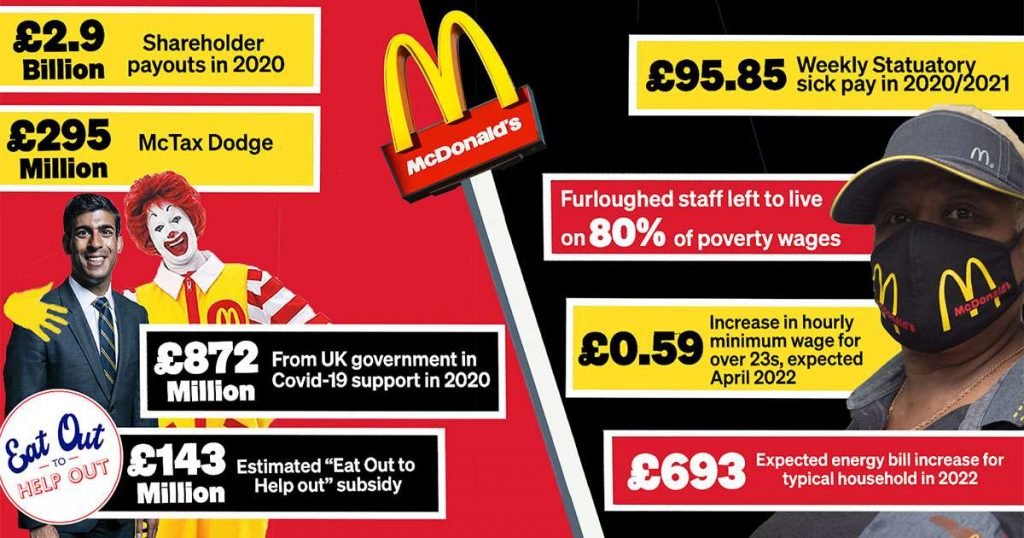

McDonald’s claimed £872m in taxpayer-funded Covid support while benefiting from a tax avoidance scheme that will deprive the UK government of hundreds of millions of pounds in tax, according to a new report.

The fast-food giant paid out a record $3.75bn (£2.8bn) to shareholders in 2020 as its drive-through restaurants remained open while many competitors were forced to close.

Throughout the pandemic, McDonald’s benefited from £297m in furlough payments, £143m through Eat Out to Help Out, £60m from business rates relief, and £372m from a VAT cut, research by campaign group War on Want calculated.

McDonald’s paid its workers poverty wages whilst they pushed sales through the roof during Covid-19 lockdowns – all while rewarding shareholders with a record £2.9 billion payout, inflated by the hundreds of millions in UK public funds that flowed into McDonald’s UK business.

Campaign group War On Want said the multinational fast-food giant initially received the massive subsidy package in 2020 —while enriching shareholders that same year by a record £2.9 billion.

This included £297m in furlough cash, £143m from the “Eat Out to Help Out” scheme, £60m from business rates relief and £372m from a temporarily reduced VAT rate for hospitality businesses.

The group’s report, Secrets and Fries, also notes lobbyists from the extremely profitable firm met Tory ministers 15 times in the same year as most of its stores were shut during two national lockdowns.

War On Want called on HM Revenue and Customs (HMRC) to investigate the company — and for Whitehall to tackle the City of London’s role as a tax haven for global corporations — instead of expecting working people to bail out tax-dodging multinationals.

The group’s Owen Espley said: “McDonald’s has been driving billions of its global income through the City of London — but not stopping to pay its fair amount of UK tax.

To add insult to injuries British workers will pay for the Covid-19 bailouts big business received instead of cracking down on corporate tax dodgers.

The report accuses the firm of creating a British tax shelter through a paper, circular transaction that moved franchising rights between Singapore and London, enabling McDonald’s to shield its global franchise income from being taxed in this country.

Initiated in 2016, the transaction saw its British-based subsidiary, McD Global Franchising Ltd, purchase the right to collect franchise fees in Asia from a McDonald’s subsidiary in Singapore for about £2.7bn.

The payment, made using a form of “IOU,” was then returned to McD Global Franchising Ltd as a dividend, via other subsidiaries.

The deal allowed the British-based subsidiary to claim an expense for buying the franchise rights, without the income being taxable when it was returned as a dividend, ultimately depriving the Treasury of nearly £300m in tax revenue over the next 10 years.

McDonald’s Corporation had altered its corporate structure following multiple exposés and scrutiny of its tax affairs at the EU and national levels.

The report reveals how its latest restructure moved its European headquarters and a number of key assets back to London to take advantage of the UK’s highly favourable tax regime. After the restructure, McDonald’s UK corporate entities receive billions in annual revenue in the form of royalty payments from McDonald’s subsidiaries around the world but pay little tax in the UK.

These practices also reduce the amount of tax McDonald’s owes in other countries around the world.

War On Want urged HMRC to investigate the transaction and the company’s current structure as its “primary purpose appears to be to create a tax avoidance scheme.”

Read the ‘Secrets and Fries’ report

Understand the McTax dodge

London tax haven

McDonald’s used the tax haven of Luxembourg to avoid paying €1 billion on its income from across Europe. After its Luxembourg tax arrangements were exposed by War on Want and others in our 2015 UnHappy Meal report, McDonald’s moved its tax base to the City of London.

The European Commission’s subsequent investigation found that McDonald’s tax arrangements were unfair, but not illegal, according to the narrow state aid rules that the European Commission uses to tackle tax dodging. However, after the European Commission started asking questions about these arrangements, McDonald’s decided it was time for a move – to the City of London, UK.

With Brexit on the horizon, placing its international tax base in the UK would move McDonald’s outside of the EU’s jurisdiction, and give it access to the UK’s favourable corporate tax regime. The UK government has been keen to attract multinationals’ intellectual property to London by offering tax breaks. UK parliamentarians must address the City of London’s role as a tax haven for global corporations.

McDonald’s billion dollar IOU to itself

In 2016, McDonald’s newly established UK-based subsidiary, McD Global Franchising Ltd, bought a franchise rights business from another McDonald’s subsidiary, McD APMEA Franchising Pte Ltd in Singapore – for $3.55 billion.

Instead of using cash for this transaction, UK-based McD Global Franchising Ltd paid for the franchise rights business using three loan notes – financial debt instruments similar to an ‘I owe you’ (IOU), a written agreement acknowledging debt. This note was then passed around the world via different McDonald’s subsidiaries, until eventually it came back to McD Global Franchising Ltd in London. Unable to owe itself money, McDonald’s cancelled the IOU.

However, the rights that UK subsidiary McD Global Franchising Ltd had acquired stayed on the books. By using an accounting process called amortisation (similar to depreciation, whereby a business asset loses value over time) – it can claim an expense for at least ten years, for the value of the rights dropping as they age, meaning less profits for it to pay tax on.

In total, this amounts to a potential tax saving of at least $40 million per year or £295 million ($400 million) over a decade. These figures are calculated at the UK corporate tax rate of 19%, and based on the amortisation McDonald’s claimed as a tax expense in 2018.

McDonald’s circular paper transaction enables royalties that McD Global Franchising Ltd receives from McDonald’s entities around the world, including from Europe, the Middle East and Africa, to be shielded from taxation in the UK. This will deprive UK public funds of at least £295 million in tax revenue over ten years.

End the McTax Dodge!

When multinational corporations such as McDonald’s dodge paying taxes, it creates unfair competition for small businesses. McDonald’s growth and increasing market dominance fuels the normalisation of poverty wages and poor working conditions. McDonald’s business model fuels growing inequality.

That’s why we can’t let McDonald’s get away with it. We can’t let McDonald’s get away with granting its shareholders huge payouts off the back of public subsidies and tax breaks, whilst its workers were paid poverty wages to put their health at risk by working during Covid-19 lockdowns, furloughed workers suffered, and thousands of local businesses were going under.

We must not let politicians force ordinary working people to fund the bailouts big business received, instead of cracking down on corporate tax dodgers. We must demand politicians rebalance our rigged economy in favour of workers and the communities where multinationals operate.

HMRC must investigate McDonald’s.

Demand HMRC investigates McDonald’s

The UK government must crack down on corporate tax dodging

Support Independent Journalism Today

Our unwavering dedication is to provide you with unbiased news, diverse perspectives, and insightful opinions. We're on a mission to ensure that those in positions of power are held accountable for their actions, but we can't do it alone. Labour Heartlands is primarily funded by me, Paul Knaggs, and by the generous contributions of readers like you. Your donations keep us going and help us uphold the principles of independent journalism. Join us in our quest for truth, transparency, and accountability – donate today and be a part of our mission!

Like everyone else, we're facing challenges, and we need your help to stay online and continue providing crucial journalism. Every contribution, no matter how small, goes a long way in helping us thrive. By becoming one of our donors, you become a vital part of our mission to uncover the truth and uphold the values of democracy.

While we maintain our independence from political affiliations, we stand united against corruption, injustice, and the erosion of free speech, truth, and democracy. We believe in the power of accurate information in a democracy, and we consider facts non-negotiable.

Your support, no matter the amount, can make a significant impact. Together, we can make a difference and continue our journey toward a more informed and just society.

Thank you for supporting Labour Heartlands