Farmers Inheritance Tax: Why the Rich Win and Farmers Lose in Britain

There is widespread misinformation about the government’s new inheritance tax policy for family farmers, fueled partly by the government’s failure to clearly explain its rationale and partly by the mistaken belief that it will also affect mega-corporations and aristocratic landowners. It won’t.

No Aristocrats or landed gentry will be hurt in the making of this legislation.

Rest assured, neither the Duke of Cornwall nor King Charles will be losing sleep over their vast estates and rolling farmlands. Their toes remain uncurled, their fortunes untouched, and their pheasant shoots uninterrupted.

When Hugh Grosvenor, 7th Duke of Westminster inherited his title and the £9 billion Grosvenor Estate, he avoided a crushing inheritance tax bill thanks to Britain’s generous trust laws. If the estate had been subject to the standard 40% inheritance tax, the amount owed would have rivalled the Treasury’s entire inheritance tax revenue for the previous year. Instead, the use of discretionary trusts ensured the estate stayed intact, immune from the financial burdens facing ordinary families and small landowners.

HMRC collected a total tax of £534bn in the year of the old Duke’s death 2015-16, of which inheritance tax receipts represented £4.7bn.

This is no accident. Britain’s trust system, designed to shield wealth, allows fortunes like the Grosvenor Estate to cascade through generations virtually untaxed. Trusts are only subject to a modest periodic charge of up to 6% every ten years, and with plenty of loopholes—such as agricultural and business property relief—even that amount is often minimized. For example, Wheatsheaf, the Grosvenor agricultural arm, and Grosvenor Farms, with its 6,000 acres and 1,400 dairy cows, are structured to qualify for exemptions.

The government claims this new inheritance tax targets “those with the broadest shoulders,” but when you follow the money that doesn’t ring true. The Duke of Westminster’s vast Grosvenor estate, with its prime London real estate and corporate holdings, sits safely in trust arrangements that effectively bypass inheritance tax. The same goes for hundreds of aristocratic estates that qualify for “tax-exempt heritage assets” status, protecting their grouse moors and pheasant shoots from the taxman’s reach.

Even celebrity “lifestyle farmers” like Jeremy Clarkson have already announced their intention to protect their agricultural investments through trust arrangements. The wealthy, as always, have escape routes.

But for genuine family farms – the backbone of British agriculture – there is no such protection. These aren’t vast estates with teams of tax lawyers. They’re working farms, often operating on tight margins, where every acre counts and every generation’s knowledge matters. The new inheritance tax threatens to break this chain of agricultural heritage.

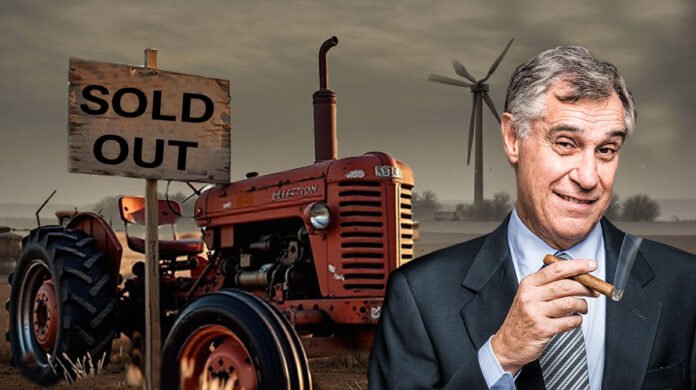

Let’s be brutally honest about what’s happening here. The government’s policy creates a two-tier system: one for the wealthy who can afford to structure their holdings through trusts and corporate entities, and another for family farmers who will be forced to sell to pay their tax bills. It’s a system so perfectly designed to facilitate corporate takeover of British farming that one might think that was the point.

When did we decide that the death of family farming was an acceptable casualty of progress? As I watch pitchfork-wielding so-called progressives celebrate policies that will decimate rural communities, I’m reminded of Orwell’s Animal Farm – though this time, it’s not the pigs who’ve taken over the farm, but the hedge funds, and by the way it’s happening all over the EU.

EU’s farmers are under pressure to go big or go bust.

The UK government’s crushing new inheritance tax on farms isn’t just poor policy – it’s the final act in a tragedy that’s been playing out across Europe for years. While critics reflexively blame Brexit, they’ve missed the bigger picture: this is part of a coordinated assault on family farming that spans the continent, where 5.3 million farmers have already gone bust in the last decade alone.

Researchers found that the number of mega-farms in the EU, with an economic output of over €250,000, jumped by 56% between 2007 and 2022, while the number of farms in the small-scale commercial category (with outputs between €2,000 and €49.999) dropped by 44% over the same time-frame.

This loss of almost two million commercial farms and 3.8 million jobs suggests that the model of small-scale family farming is dying out through regressive taxes. At the same time, only 306,000 more people are now employed in mega-farms. Overall employment on commercial farms in the EU dropped by 38% between 2007 and 2022…

You do see where this is going, don’t you….

Let’s be clear about what we’re witnessing: This isn’t evolution – it’s extinction by design. Investment funds, wielding billions in capital, are circling rural communities like vultures, turning our countryside into Excel spreadsheets of profit margins. When Carlos Fernández, a farmer in central Spain, speaks of an “evil eye” watching their lands, he’s not being paranoid. He’s describing the cold calculation of corporate agriculture that sees “unprofitable” family farms as prime real estate for consolidation.

The numbers tell a devastating story: 37% of EU farmers have disappeared in ten years. Meanwhile, mega-farms with outputs over €250,000 have increased by 56%. This isn’t market efficiency – it’s market cannibalism. The same investment funds that crashed our economy in 2008 now view our farmland as their next great opportunity, promising 15% returns while local farmers struggle to break even.

What’s most perplexing is the cheerleading from the left. The same voices that rail against corporate monopolies and wealth inequality are strangely silent – or worse, supportive – as investment firms like M&G and BNP Paribas orchestrate the largest transfer of agricultural wealth in European history. These self-proclaimed champions of the working class seem to have forgotten that family farmers are the original working class.

And no, this won’t be just around 500 farms a year…

For those who care for the truth…here are the real stats on this land grab.

The farming minister, Daniel Zeichner, has also said there is a “discrepancy” in the numbers, with the National Farmers’ Unionsaying Defra’s own figures show that 66% of the UK’s 209,000 farms are worth more than £1m and so potentially eligible to be taxed. Tom Bradshaw, the NFU president, said: “Far from protecting smaller family farms, which is what ministers say they’re doing, they’re actually protecting private houses in the country with a few acres let out for grazing while disproportionately hammering actual, food-producing farms, which are, on paper, much more valuable. Even Defra’s own figures show this, which is why they’re so different to the Treasury data this policy is based on.”

Death and Taxes: Why Britain’s Family Farmers Are the Real Victims

A Legacy of Food Security Under Attack

Since 1992, Britain understood a fundamental truth: the security of our food supply depends on keeping farmers on their land. Agricultural Property Relief (APR) wasn’t a tax dodge for the wealthy – it was a recognition that farming isn’t just another business. It’s the foundation of our national security and cultural heritage.

For three decades, this policy helped ensure that family farms could pass from generation to generation, preserving not just land but knowledge, tradition, and commitment to sustainable agriculture. These weren’t wealthy estate owners playing at farming – they were families working difficult, often financially precarious jobs because it was their heritage and their community’s lifeblood.

Now, with a stroke of a pen, this carefully crafted support system is being dismantled. From April 2026, the government’s new inheritance tax regime will restrict full relief to just £1 million of combined agricultural and business property. Beyond that, even the “generous” reduced rate of 20% represents a death sentence for many family farms.

Let’s be clear about what this means in practice. When a farm passes to the next generation, they’ll face a stark choice: sell land to pay the tax bill or take on crushing debt. The government’s offer of interest-free payments over 10 years sounds generous – but for farms operating on tight margins, it’s like being offered a choice between drowning quickly or slowly.

This isn’t just about individual farms – it’s about national resilience. The UK now produces less than 60% of its food, a frightening statistic in an increasingly unstable world. Each family farm that succumbs to this tax pressure, each acre sold to corporate agriculture or development, pushes that percentage lower.

This is death by attrition. Each generation will face the same brutal mathematics: sell land to pay taxes, making the farm less viable for the next generation, who will then have to sell more land. It’s a downward spiral that can end only one way – with family farms vanishing into corporate agricultural empires or housing developments.

Meanwhile, the truly wealthy continue to protect their vast estates through trusts and corporate structures, their “heritage assets” safe from the taxman’s reach. As I’ve pointed out the Duke of Westminster’s and his ilks billions will remain intact while fourth-generation farmers calculate how much of their heritage they’ll have to sell to keep the rest.

This isn’t modernisation – it’s liquidation. We’re not just losing farms; we’re losing food security, biodiversity, and centuries of agricultural knowledge. We’re trading the careful stewardship of family farmers for the profit-driven calculations of corporate agriculture.

Again, the UK’s inheritance tax proposal isn’t just bad policy – it’s a death sentence for family farms. It forces the next generation to either sell to corporate buyers or watch their heritage be auctioned off to pay the tax bill. This isn’t accidental; it’s architectural. The government is effectively acting as a real estate agent for corporate agriculture, forcing sales that transform diverse family farms into industrial monocultures.

Automated mega-farms that treat soil as a commodity and workers as disposable resources.

This isn’t about resisting change or protecting inefficiency. Family farms have always evolved and adapted. But there’s a profound difference between evolution and extinction. The current policies aren’t modernising agriculture – they’re monetizing it at the expense of food security, environmental stewardship, and rural communities.

The cruel irony is that this transformation is happening just as we’re recognising the vital importance of local food systems and sustainable agriculture. Investment funds may promise efficiency, but their track record suggests they’ll prioritise short-term profits over long-term sustainability every time.

Those celebrating these changes should ask themselves: Do we really want our food system controlled by the same financial institutions that triggered the 2008 crash? Do we trust hedge funds to be the custodians of our agricultural heritage and food security?

You need only look at the publicly available information to see how both corporations and the aristocracy are shielded by legislation. Consider the mechanics: The Grosvenor estate divides its holdings into three carefully structured portfolios – Grosvenor Group, Wheatsheaf, and the Family Investment Office. Each is strategically positioned to maximize tax advantages and minimize liability. Their agricultural holdings, managed through Wheatsheaf, employ 450 people and run one of Britain’s largest farms. Yet through careful corporate structuring, they avoid the periodic inheritance tax charge that would apply to lesser holdings.

Meanwhile, traditional family farms face a stark choice: sell or surrender to corporate agriculture. The tax bill comes due just when the next generation needs capital to invest in the farm’s future. It’s a policy that doesn’t just tax inheritance – it taxes the future of British farming itself.

The alternatives are clear. As Unite the Union and the Workers Party of Britain have pointed out, a 2% tax on wealth above £10 million could raise £24 billion. Then again that target would hit a few on Labour’s front bench never mind the Tories, hard to see how that would pass in a millionaire-rich House of Commons.

A more considered and targeted approach: make inheritance tax payable only if the farm is sold outside the family after the owner’s death, while suspending it for genuine intergenerational transfers within farming families.

But such solutions would require confronting the real concentrations of wealth and power in British society. Instead, we have a policy that preserves the privileges of the landed gentry while accelerating the corporate takeover of British agriculture.

The new policy won’t significantly change this ratio – but it will change the face of British farming forever.

This isn’t just about tax policy. It’s about the kind of country we want to be. Do we want a countryside dominated by corporate agriculture and preserved aristocratic estates? Or do we want to protect the family farms that have been the stewards of our land for generations?

The government’s “tractor tax” presents itself as a reform targeting the wealthy. In reality, it’s a mechanism for transferring land from family farmers to corporate agriculture, all while leaving the truly wealthy untouched. It’s not reform – it’s redistribution in reverse.

As our rural communities face this existential threat, the silence from supposed progressives is deafening. Perhaps they should consider that once family farms are gone, they’re gone forever – replaced not by some pastoral socialist ideal, but by corporate agriculture that answers only to shareholders.

I suggest the liberal left put down their pitchforks and ask who really benefits from this. Here’s a bet: by next season, your veg will come stamped with “Grown in Ukraine – Support the War Effort, Slava Ukraini“ courtesy of BlackRock. Meanwhile, the British countryside will be transformed—vast swathes replaced by solar farms, wind turbines, and sprawling housing developments as corporate developers gleefully cash in on government quotas.

As Karl Polanyi warned in “The Great Transformation,” when we reduce land to mere commodity, we risk destroying the very fabric of society.

Support Independent Journalism Today

Our unwavering dedication is to provide you with unbiased news, diverse perspectives, and insightful opinions. We're on a mission to ensure that those in positions of power are held accountable for their actions, but we can't do it alone. Labour Heartlands is primarily funded by me, Paul Knaggs, and by the generous contributions of readers like you. Your donations keep us going and help us uphold the principles of independent journalism. Join us in our quest for truth, transparency, and accountability – donate today and be a part of our mission!

Like everyone else, we're facing challenges, and we need your help to stay online and continue providing crucial journalism. Every contribution, no matter how small, goes a long way in helping us thrive. By becoming one of our donors, you become a vital part of our mission to uncover the truth and uphold the values of democracy.

While we maintain our independence from political affiliations, we stand united against corruption, injustice, and the erosion of free speech, truth, and democracy. We believe in the power of accurate information in a democracy, and we consider facts non-negotiable.

Your support, no matter the amount, can make a significant impact. Together, we can make a difference and continue our journey toward a more informed and just society.

Thank you for supporting Labour Heartlands