Rethinking Monetary Policy: Addressing the Covert Corporate Welfare of QE and Greed

In the United Kingdom, a resounding resurgence of corporate welfare has taken shape, with Quantitative Easing (QE) at its core. Initiated by central banks in response to the 2008 financial crisis, QE has proven to be a veiled form of corporate welfare, disproportionately benefiting the affluent while exacting costs from the working class and the middle class.

The Bank of England’s acquisition of over £895 billion in bonds reveals the depth of this phenomenon. The lion’s share, totalling £875 billion, comprised UK government bonds, while the remaining £20 billion were UK corporate bonds.

While presented as a mechanism to stimulate investment and lending, QE’s chief outcome has been the artificial suppression of asset yields. Consequently, asset valuations have soared, disproportionately enriching the top 5% of households who collectively own 40% of all assets.

This inflationary trajectory, however, exacts a hidden toll as QE simultaneously devalues currencies, functioning as an insidious tax on imports and everyday necessities. Tragically, this disproportionately affects the working class as well as the middle class, while posing as a strategy for prosperity.

While ostensibly intended to stimulate investment and lending, QE’s primary effect has been to artificially suppress asset yields, resulting in inflated valuations that disproportionately benefit the top 5% of households who own 40% of assets. QE also devalues currencies, acting as a stealth tax on imports and everyday goods that hits the working middle class hardest. While some claim currency debasement can foster prosperity, history shows stable currencies support broader-based growth.

Some contend QE was intended to create a ‘trickle-down’ effect by boosting asset prices. But ‘trickle-down’ is a failed theory, and the winner-takes-all impacts of QE are apparent. The wealthiest 10% now own 70% of assets, and billionaire wealth has surged.

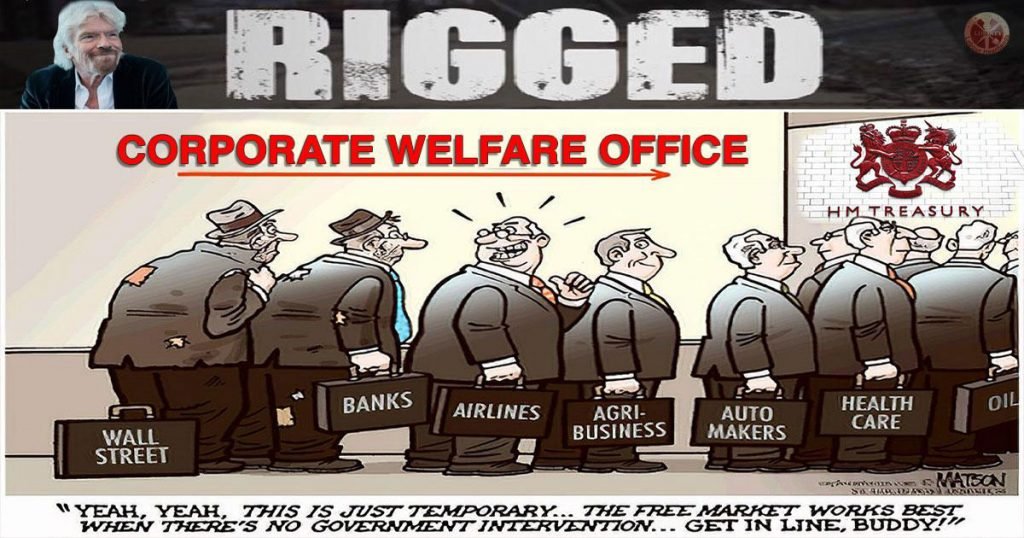

By blurring the lines between monetary and fiscal policy, QE has enabled central banks to provide covert aid benefiting powerful corporate interests. QE’s effect is to provide corporate welfare for the already wealthy.

Covid witnessed a massive revival of corporate welfare — only this time, rather than bailing out their financial sectors, governments are bailing out the entire capitalist class. On top of the $9 trillion worth of QE that’s been undertaken since the pandemic began, governments all around the world have spent trillions on loans and subsidies to big businesses, financiers, and landlords. Most have also provided some support for workers; yet without breaks on debt, rent, and bills, much of this has ended up in the pockets of the wealthy too.

As the true ramifications of QE emerge, the convergence of monetary and fiscal policies warrants a comprehensive reevaluation. Coinciding with this covert corporate welfare, the emergence of billionaire wealth further amplifies economic disparity. Since 2020, the richest 1% amassed a staggering $26 trillion, while the rest of the world managed to garner only $16 trillion.

Amid the cost-of-living crisis, this gulf widens as excess corporate profits fuel a rapid rise in inflation. While billionaire fortunes ascend by $2.7 billion each day, over 820 million individuals endure hunger, with women and girls disproportionately affected.

It is a tax on all classes, corporate welfare masked as policy. As its true impact becomes apparent, the blurring of monetary and fiscal policy requires re-examination.

Rise in UK company profits puts Bank’s stance on prices under scrutiny

The Bank of England’s assertion that quantitative easing (QE) serves as a bulwark against inflation crumbles when confronted with the stark evidence.

Recent official figures unveil a disconcerting reality: British companies have managed to bolster their profitability. This revelation fuels assertions that profiteering, rather than external cost pressures, has substantially contributed to the UK’s ongoing inflation narrative.

Amidst a week marked by Joe Biden’s claim that the US was taming inflation due to declining corporate profits, the Office for National Statistics divulged data on Thursday indicating that UK business profits surged in the first quarter of 2023. Manufacturing enterprises amplified their net rate of return to 8.8% during the initial quarter, up from 8.4% in the last quarter of 2022. Notably, services companies, commanding around three-quarters of the nation’s economic activity, augmented their net rate of return to 16.1%. This increment of 0.4 percentage points reflects the final three months of 2022.

This return rate, a gauge of profitability gauging the margin between operating profits and asset-related costs, has witnessed unions accusing firms of inflating prices beyond the escalation in their expenditures, dubbing this trend “#greedflation.”

This discourse holds significance as the Bank of England has consistently dismissed the marginal fluctuations calculated by the ONS in its corporate profitability assessments as indicative of minimal profiteering. The institution has continuously urged wage restraint among workers and downplayed the need to regulate corporate price hikes.

On the opposing front, an expanding cadre of academics, think tanks, and unions present an alternative narrative. TUC General Secretary Paul Novak expressed shock at the ONS figures, attributing blame for elevated prices to large corporations exhibiting a “culture of entitlement.” Sharon Graham, the head of the Unite union, lauded for her role in spearheading corporate profit research, stated that companies were exploiting the crisis.

Philip King, a former government adviser and small business commissioner, asserted that many small and medium-sized enterprises would perceive the controversy as unwarranted. He asserted that the figures conclusively demonstrate that “companies are maintaining their profitability despite the difficult trading conditions they have faced,” pointing the finger at larger businesses, which possess greater flexibility in price hikes and cost reduction.

The assessments of international bodies align with this discourse. The International Monetary Fund (IMF) and the Organisation for Economic Co-operation and Development (OECD), alongside prominent academics, posit that stable profit margins indicate that businesses outperform other participants in the economy, particularly workers.

Intriguingly, the OECD’s recent report revealed a nearly 25% surge in average profit margins in the UK between the conclusion of 2019 and the outset of 2023. The puzzle deepens as Stefano Scarpetta, an OECD director, noted the paradoxical phenomenon of profit growth amid an economic activity slowdown.

George Dibb, an economist at the IPPR think tank, flatly contradicts the Bank of England’s perspective on steady profit margins being an inconsequential story. Upon closer examination, the headline average unveils an even bleaker reality. The net rate of return for all non-financial businesses, excluding banking and insurance companies but encompassing North Sea oil and gas enterprises, rose from 9.8% in the final quarter of 2022 to 9.9% in the initial quarter. This persistence of margins during a period of harsh living cost escalations and dwindling disposable incomes across generations offers a glaring portrait.

However, with the exclusion of North Sea oil and gas entities, whose profits dipped due to falling energy prices, the profitability level for most firms skyrocketed from 9.6% in the last quarter of 2022 to 10.6% in the first quarter of 2023.

Richard Murphy, a University of Sheffield professor of accounting, underscores that nominal wage hikes in most sectors beyond financial services likely signify that larger companies are faring better than their smaller counterparts. Murphy points out that while half of all UK company profits stem from small and medium-sized enterprises, the remaining half is attributed to a few thousand larger firms.

As the anticipation of another interest rate hike looms next month, the Bank’s justification will likely focus on the rapid rise in wages rather than an upsurge in profits. This stance is poised to ignite increasing contention and scrutiny.

The solution to this predicament finds its foundation in adopting a 21st-century Keynesian economic policy. It calls for a strategic realignment of resources towards endeavours that tangibly uplift the entire populace. By offering support to domestically manufactured goods. This entails subsidising farmers for goods produced locally, propelling the growth of green energy initiatives, and championing the nationalisation of energy corporations. These measures offer a more balanced and just trajectory for society to follow.

At its core, this covert corporate welfare must be laid bare as a pivotal turning point. It compels us to recalibrate our policies and reshape our economic panorama to foster inclusivity and fairness. The time has come to wield this exposure as a catalyst for vital transformation, striving for a future where prosperity is shared by all, not just the privileged few.

Support Independent Journalism Today

Our unwavering dedication is to provide you with unbiased news, diverse perspectives, and insightful opinions. We're on a mission to ensure that those in positions of power are held accountable for their actions, but we can't do it alone. Labour Heartlands is primarily funded by me, Paul Knaggs, and by the generous contributions of readers like you. Your donations keep us going and help us uphold the principles of independent journalism. Join us in our quest for truth, transparency, and accountability – donate today and be a part of our mission!

Like everyone else, we're facing challenges, and we need your help to stay online and continue providing crucial journalism. Every contribution, no matter how small, goes a long way in helping us thrive. By becoming one of our donors, you become a vital part of our mission to uncover the truth and uphold the values of democracy.

While we maintain our independence from political affiliations, we stand united against corruption, injustice, and the erosion of free speech, truth, and democracy. We believe in the power of accurate information in a democracy, and we consider facts non-negotiable.

Your support, no matter the amount, can make a significant impact. Together, we can make a difference and continue our journey toward a more informed and just society.

Thank you for supporting Labour Heartlands