Banks are up the working poor are down.

Rishi Sunak has unveiled his Budget with the fanfare of a Chancellor with money to burn.

The chancellor painted a positive picture of the health of the UK economy as it emerges from the pandemic, in his autumn statement to a packed House of Commons.

He claimed he’ll be pumping £150billion into the economy by 2025 as the UK recovers from the Covid pandemic.

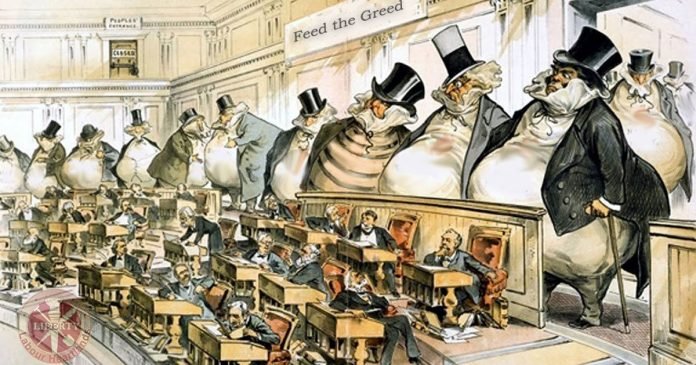

It is distressing but not all that surprising to see the main priority for the former investment banker and hedge fund manager, Chancellor Sunak, was to feed the fat cats first. While the rest of humanity suffers, the fat cats, the financially robust, the lobbyists, the bankers, all have access to power to ensure that they will not only survive the crisis along with the economic downturn but thrive on it.

Looking after their own.

Sunak’s decision to cut tax surcharges for bank profits by more than half in his Autumn Budget shows the ‘levelling up’ really means. It’s little more than a continuation of feeding the rich while the rest are stuffed full of trickle-down theories and slogans of hard work pays.

Chancellor Sunak, a former investment banker and hedge fund manager, has cut the tax surcharge on bank profits in this week’s Budget to help boost London’s competitiveness as a global financial centre.

Sunak announce that the surcharge will be cut from 8% to 3% (a cut of 62.5%) from April 2023 when he announces the UK Government’s spending plans on Wednesday, October 27.

It comes ahead of a hike in corporation tax from 19% to 25% in 2023, which Sunak had cautioned risks making “the taxation of banks uncompetitive”.

Banks currently pay 27% tax on profits, of which 19% is corporation tax and 8% the bank surcharge.

They would see their overall corporation tax charge increase to 33% in 2023 if the surcharge was not reduced but the expected reduction would instead rise to 28%, an increase of just one percent.

The Treasury said it would also ensure the UK can continue to compete with other financial sectors including New York and Germany, where the effective tax rates for banks are 26% and 32% respectively.

Together, the surcharge cut and the allowance increase will cost the Treasury about £4bn in the five years to 2027, according to the Office for Budget Responsibility’s forecasts on bank profitability.

Simon Youel, the head of policy and advocacy at campaign group Positive Money, said: “At a time when ordinary workers are facing a cost of living crisis, with cuts to universal credit, hikes to national insurance, and rising household bills, cutting taxes for bankers is a worrying sign of the government’s priorities.”

Of course, this will make British Banking much more competitive but that ‘trickle down’ has never worked before, we don’t expect it to work any time soon.

The working poor see hard times.

The cut to taxes for banks comes less than a month after the UK cut Universal Credit for millions and as a hike in National Insurance payments set to be introduced. These are not cuts for the supposed ‘Idle Poor’ (if they ever existed) that usual demographic of Tory abuse, no, these are cuts to the overworked, overlooked, working poor, families struggling to make ends meet while facing massive price hikes at supermarkets and fuel stations.

These are the 2 million workers paid at or below the minimum wage, according to The Low Pay Commission.

Much of his Budget had been pre-announced, including an end to the public sector pay freeze and an increase to the National Living Wage from £8.91 per hour to £9.50.

The £2bn to Universal Credit announced on Wednesday will help ameliorate the pain from the withdrawal of the £20-a-week uplift – worth £6bn, there will be winners and losers with some of the poorest families in the UK worse off.

Universal Credit taper rate will be cut by 8% no later than 1 December, bringing it down from 63% to 55% – allowing claimants to keep more of the payment.

Paul Johnson, director of the Institute for Fiscal Studies, described the outlook for household finances as “actually awful”.

But Paul Johnson told BBC News the “almost non-existent” increase in living standards predicted over the next five years was a “big blow” to families.

“The economy’s not really growing very fast, so it’s likely on average people’s incomes will only be crawling over the next three, four even five years and certainly some people, particularly those whose wages don’t go up as fast, will be feeling worse off. So this is not a period of people feeling better I’m afraid.”

Mr Sunak, perhaps alive to that risk, did use this budget to inject the prospect of a more feel good taxation policies ahead of a general election by setting himself up for tax cuts just before the country goes back to the polls.

Household disposable income is set to rise by 0.8% per year, according to Office for Budget Responsibility figures.

Economic growth is forecast to rise to 6.3% next year – higher than previously predicted – but it will then slow to 1.3% by 2023.

The Office for Budget Responsibility forecasted inflation would peak at 4.4% in 2022 – but could climb to 5.4%.

That soaring inflation means higher goods and energy bill prices in the shops.

And it could lead to the Bank of England base rate – and therefore mortgage rates – being raised in a big way for the first time in more than a decade. Mr Sunak did not rule out this grim prospect.

The Chancellor’s refusal to scrap the five percent VAT on energy amounts to an outright betrayal of Brexit voters, according to Mike Foster, CEO of the Energies and Utilities Alliance (EUA).

“I think it’s a real letdown for consumers.

“They had been promised the cut back in the Brexit referendum and perhaps forgot about it until energy prices started to rocket.

“Suddenly, it becomes a far more pressing matter for consumers when they are seeing their energy bills rise by hundreds of pounds a year, and five percent of that going straight to the taxman even though the Prime Minister had made it very clear he was going to scrap that tax.

“And so there was an opportunity today to put the matter right but I think a lot of people will feel betrayed.”

Support Independent Journalism Today

Our unwavering dedication is to provide you with unbiased news, diverse perspectives, and insightful opinions. We're on a mission to ensure that those in positions of power are held accountable for their actions, but we can't do it alone. Labour Heartlands is primarily funded by me, Paul Knaggs, and by the generous contributions of readers like you. Your donations keep us going and help us uphold the principles of independent journalism. Join us in our quest for truth, transparency, and accountability – donate today and be a part of our mission!

Like everyone else, we're facing challenges, and we need your help to stay online and continue providing crucial journalism. Every contribution, no matter how small, goes a long way in helping us thrive. By becoming one of our donors, you become a vital part of our mission to uncover the truth and uphold the values of democracy.

While we maintain our independence from political affiliations, we stand united against corruption, injustice, and the erosion of free speech, truth, and democracy. We believe in the power of accurate information in a democracy, and we consider facts non-negotiable.

Your support, no matter the amount, can make a significant impact. Together, we can make a difference and continue our journey toward a more informed and just society.

Thank you for supporting Labour Heartlands