Davide Cameron, an example of the old boys club, Tory sleaze and political corruption proving it’s all just as vibrant and alive today as when John Major was heading the Tory feeding frenzy on public money.

If the coronavirus pandemic has shown us anything about human nature it has shown how quickly politicians and those with access from all parties and all countries are quick off the foot to put their heads in the trough. Cameron is just the latest talking point with his controversial attempts to influence serving government ministers on behalf of Greensill, a now-collapsed finance firm that hired him as an adviser opening that ever-present revolving door.

The latest twist in the story — a senior government official given the green light to work for Greensill for months while still retaining his civil service job — yet another headache for Boris Johnson.

Today a government minister claimed David Cameron did not do anything wrong when lobbying for Greensill Capital and “meticulously observed the rules”, the environment secretary told Sky News.

George Eustice also said current rules on lobbying are “pretty good”.

Mr Eustice added: “I don’t think he took advantage of any rules, no. He meticulously observed the rules that he himself actually put in place after some concerns around lobbying a decade ago. He put in place these restrictions on what ministers can do for a period of two years.”

The environment secretary did concede, however, that Mr Cameron might have taken a different approach.

“He himself has said that with hindsight it probably would have been better if, rather than texting ministers, he had instead written letters to set out his views more formally,” Mr Eustice said.

“He himself has conceded that if he had his time again, he wouldn’t have texted Rishi Sunak and wouldn’t have texted others – he would instead have written through formal channels.”

Regarding rules on lobbying, Mr Eustice said: “Fundamentally, I think the systems we have in place with ministers declaring interests with the ministerial code and the focus on that and how ministers conduct themselves in office is actually a pretty good one.

“But that is not to say you couldn’t make tweaks or changes, and also there will be a time and a place for that after these reviews have concluded.”

That’s one way of pre-empting the outcome of an enquiry…

Yet transparency campaigners and even Westminster’s lobbyists themselves point out that the steady drumbeat of revelations comes in spite of, and not because of, the U.K.’s promises about open government.

“The whole system doesn’t work, everyone knows it doesn’t work, everyone’s known for years it doesn’t work. -David Cameron

David Cameron knew it didn’t work, which is exactly why his actions didn’t turn up anywhere on any official disclosure,” said Steve Goodrich, senior research manager at Transparency International UK.

The Greensill saga has two main parts. There’s the access afforded to the firm’s founder Lex Greensill when Cameron was in government, with Greensill brought in to combat “wasteful contracts” and advise on supply-chain finance. Then there are the headline-grabbing efforts by Cameron to lobby for Greensill once he’d left office and, in 2018, become a paid adviser to the firm.

Text messages sent to Chancellor Rishi Sunak, making the case for Greensill to be part of a key coronavirus business lending scheme, have raised eyebrows, as has a reported drink with Health Secretary Matt Hancock. Although Cameron’s pleas were ultimately rejected by the Treasury, Sunak told the former Conservative leader he had “pushed” officials to consider the proposal.

Cameron broke weeks of silence last Sunday to acknowledge he had learned “important lessons” from the row and say he should have engaged Sunak “through only the most formal of channels” to ensure “no room for misinterpretation.” Yet Cameron also pointed out he was “breaking no codes of conduct and no government rules.”

That, argue those pushing for transparency reform, is precisely the point.

No one is talking about the fallout, the money the losses

Who Pays?

No matter how this enquiry turns out whitewash or example made there are other questions left unanswered when all the dust settles, who is going to pick up the bill and defaults caused by Greensills collapse?

Downing Street’s dodgy dealings with Citigroup and Greensill show just how far the British government is willing to go to line the pockets of banks and other financial firms while bleeding taxpayers dry.

The collapse of UK-based supply chain finance firm Greensill Capital continues to reverberate. In Germany, the private banking association has paid out around €2.7 billion to more than 20,500 Greensill Bank customers as part of its deposit guarantee scheme after the bank collapsed in early March. But the deposits of institutional investors such as other financial institutions, investment firms, and local authorities are not covered. Fifty municipalities are believed to be nursing losses of at least €500 million.

Greensill’s biggest source of funds, Credit Suisse, has seen its share price plunge by almost a quarter. This is due not only to the fallout from Greensill’s collapse but also the impact of losses at its prime brokerage division caused by the stricken U.S. hedge fund Archegos, which are expected to reach €4 billion. The lender has warned of “considerable uncertainty” regarding the valuation of its supply chain finance fund. More than $5 billion of the roughly $10 billion invested in the fund remains outstanding.

Credit Suisse had assured clients in marketing documents that the debt in the supply chain fund was “low risk”. In one factsheet, it also said: “The underlying credit risk of the notes is fully insured by highly rated insurance companies.” At the beginning of March, that turned out not to be true. Some clients whose money remains trapped in the fund have threatened to sue.

Greensill’s biggest client, Anglo-Indian steel magnate Sanjeev Gupta, is on the verge of bankruptcy. Gupta’s GFG Alliance reportedly owes Greensill more than €3 billion. It began defaulting on its obligations after Greensill stopped lending to the group at the beginning of March. At the end of March Gupta requested a £170 million emergency loan from the UK government, which was duly rejected. Greensill’s administrator, Grant Thornton, has been unable to verify invoices underpinning some of the loans to Gupta. Companies listed on the documents denied ever having done business with the metals magnate.

Now the fallout is beginning to splatter the British government, which invited Greensill to participate in its Coronavirus Large Business Interruption Loan Scheme (CLBILS). This is despite the fact the company: a) wasn’t a bank; and b) was quite clearly already in deep financial trouble. Greensill’s participation in CLBILS allowed it to extend even more loans, this time government backed, to Gupta’s empire. Taxpayers will now probably end up holding the bag for those loans.

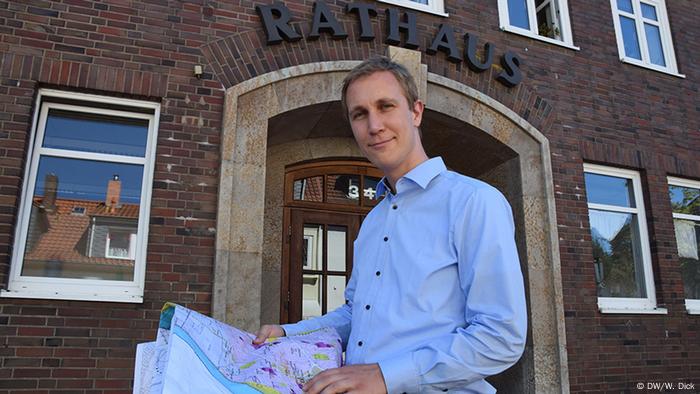

The town’s mayor Daniel Zimmermann said Monheim had turned to Greensill to avoid paying negative interest rates by depositing the funds elsewhere

Deutsche Welle News reported for am/rt (AFP, Reuters)

In Germany, it’s hit high and low as German town fears huge loss on Greensill bank investment

The potential loss to Monheim am Rhein equates to about €1,000 per inhabitant. Germany’s financial regulator has frozen the Greensill bank’s operations.

The mayor of a small German town warned on Thursday it could lose about €38 million ($46 million) invested in Greensill Bank.

Monheim am Rhein, a town of just over 42,000 people between Cologne and Düsseldorf, is set to lose about €1,000 per person.

“It is possible that we lose the entire amount of invested money,” mayor Daniel Zimmermann told council members in a letter. The audit team of the town is set to meet on Tuesday to discuss the matter.

Germany’s financial regulator, the Federal Financial Supervisory Authority (BaFin), froze the bank’s operations on Wednesday, citing an “imminent risk” of over-indebtedness.

German towns vulnerable to Greensill losses

The smaller town of Bad Dürrheim in Germany is also set to lose €2 million that it had placed in the bank, according to a statement released on Thursday.

Germany’s deposit protection scheme doesn’t protect institutional investors.

Both Bad Dürrheim and Monheim said that they had invested with Greensill to avoid paying negative rates on the funds elsewhere.

“We are now examining whether these cash investments constitute a violation of the city’s investment guidelines,” said Zimmermann.

Greensill was not available for a comment on the situation in the German towns, according to a Reuters report.

How Greensill got into trouble

The bank is a subsidiary of the troubled British group, Greensill Capital. The parent company is preparing to file for bankruptcy, according to reports in the Financial Times and Bloomberg News.

The company, which primarily deals in supply-chain financing, incurred major losses after backing two Swiss asset managers. Its dealings with GFG Alliance Group, a UK conglomerate, have also come under scrutiny.

BaFin has expressed concerns with accounting regularities at the German subsidiary of Greensill.

“During a special forensic audit, Bafin found that Greensill Bank AG was unable to provide evidence of the existence of receivables in its balance sheet that it had purchased from the GFG Alliance Group,” the regulator said.

Support Independent Journalism Today

Our unwavering dedication is to provide you with unbiased news, diverse perspectives, and insightful opinions. We're on a mission to ensure that those in positions of power are held accountable for their actions, but we can't do it alone. Labour Heartlands is primarily funded by me, Paul Knaggs, and by the generous contributions of readers like you. Your donations keep us going and help us uphold the principles of independent journalism. Join us in our quest for truth, transparency, and accountability – donate today and be a part of our mission!

Like everyone else, we're facing challenges, and we need your help to stay online and continue providing crucial journalism. Every contribution, no matter how small, goes a long way in helping us thrive. By becoming one of our donors, you become a vital part of our mission to uncover the truth and uphold the values of democracy.

While we maintain our independence from political affiliations, we stand united against corruption, injustice, and the erosion of free speech, truth, and democracy. We believe in the power of accurate information in a democracy, and we consider facts non-negotiable.

Your support, no matter the amount, can make a significant impact. Together, we can make a difference and continue our journey toward a more informed and just society.

Thank you for supporting Labour Heartlands