How the World’s Biggest Corporation Secretly Uses Tax Havens to Dodge Taxes

Walmart is the world’s largest corporation. It truly is the poster child for corporate America and boasts an annual revenue of $482,000,000,000.

What people are often not aware of, is that Walmart is stripping capital out of countries where it was earned and laundering it through a complex web of subsidiary companies in tax havens around the world.

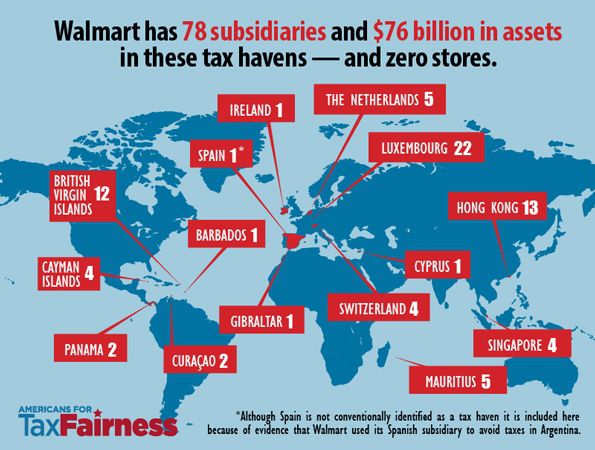

Currently, it is estimated that there is upwards of $76,000,000,000 hidden in these tax havens. This corporate behaviour is seldom seen in retail, but due to Walmart’s global reach, they have been able to exploit the same tax avoidance schemes normally reserved for Banks. This allows Walmart to shift profits offshore through unfathomably convoluted methods.

Walmart hid $76bn of assets in tax havens across the world, including $64.2bn managed by 22 different subsidiaries in Luxembourg, where Walmart has no stores, according to a study published on Wednesday.

The study, published by campaign group Americans for Tax Fairness and funded by the United Food and Commercial Workers International Union, alleged that Walmart has “kept its tax haven subsidiaries secretive by burying mention of their existence”. Walmart denied the claims.

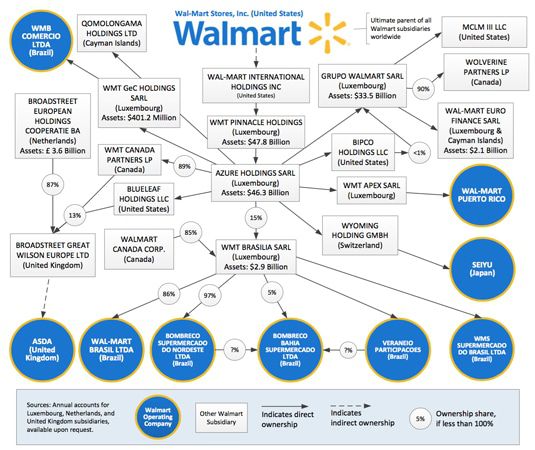

The authors claimed Walmart’s global empire keeps billions of dollars of assets away from the prying eyes of the taxman via a network of shell companies in Luxembourg, the Netherlands and a host of Caribbean countries known for their low taxes.

Subsidiary companies established to avoid taxation

In 1999, Asda was bought by Walmart for £6.7 billion for it to become one of many subsidiaries of the giant multinational company.

A groundbreaking report reveals that Walmart has built a vast, undisclosed network of 78 subsidiaries and branches in 15 overseas tax havens, which may be used to minimize foreign taxes where it has retail operations and to avoid U.S. tax on those foreign earnings. These secretive subsidiaries have never been subject to public scrutiny before. They have remained largely invisible, in part because Walmart fails to list them in its annual 10-K filings with the U.S. Securities and Exchange Commission (SEC). Walmart’s preferred tax haven is Luxembourg, dubbed a “magical fairyland” for corporations looking to shelter profits from taxation.

The report, The Walmart Web: How the World’s Biggest Corporation Secretly Uses Tax Havens to Dodge Taxes, is the first-ever comprehensive documentation of the company’s use of tax havens. The full report is available here, and for the report’s Key Findings, click here.

Key Findings

Most people know that Walmart is the world’s biggest corporation. Virtually no one knows that Walmart has an extensive and secretive web of subsidiaries located in countries widely known as tax havens. Typically, the primary purpose for a corporation to set up subsidiaries in tax havens where it has little to no business operations and few, if any, employees is to pay little, if any, taxes and to maintain financial secrecy.

Walmart has established a vast and relatively new web of subsidiaries in tax havens, while avoiding public disclosure of these subsidiaries.

All told it has 78 subsidiaries and branches in 15 offshore tax havens, none of them publicly reported before. They have remained invisible to experts on corporate tax avoidance in part because of the way Walmart has filed information about them to the U.S. Securities and Exchange Commission (SEC). Walmart may be skirting the law as there is a legal requirement to list subsidiaries that account for greater than 10 percent of assets or income.

Luxembourg, dubbed a “magical fairyland” by one tax expert because of its ability to shelter profits from taxation, has become Walmart’s tax haven of choice.

It has 22 shell companies there – 20 established since 2009 and five in 2015 alone. Walmart does not have one store there. Walmart has transferred ownership of more than $45 billion in assets to Luxembourg subsidiaries since 2011. It reported paying less than 1 percent in tax to Luxembourg on $1.3 billion in profits from 2010 through 2013.

Walmart has made tax havens central to its growing International division, which accounts for about one-third of the company’s annual profits.

At least 25 out of 27 (and perhaps all) of Walmart’s foreign operating companies (in the U.K. Brazil, Japan, China and more) are owned by subsidiaries in tax havens. All of these companies have retail stores and many employees. Walmart owns at least $76 billion in assets through shell companies domiciled in the tax havens of Luxembourg ($64.2 billion) and the Netherlands ($12.4 billion) – that’s 90 percent of the assets in Walmart’s International division ($85 billion) or 37 percent of its total assets ($205 billion).

There is evidence that Walmart uses its subsidiaries in tax havens to pursue well-known international tax-avoidance strategies:

- In 2014, Walmart’s tax-haven subsidiaries provided U.S. affiliates access to $2.4 billion in foreign earnings – in the form of low-interest, short-term loans – which may transgress U.S. law.

- Walmart generates about $1.5 billion worth of tax deductions in Luxembourg each year by making phantom interest payments to its U.S. global parent. It uses a “hybrid loan,” which makes this income disappear for tax purposes here and in Luxembourg.

- Walmart’s use of inter-company debt permits it to avoid taxes overseas. It strips earnings out of higher-tax countries by taking out inter-company loans and pays interest to itself in tax havens where the interest income is taxed lightly or not at all.

Walmart appears to be playing a long game – from tax deferral to profit windfall.

It is using tax-haven subsidiaries to minimize foreign taxes where it has retail operations and to avoid U.S. tax on those foreign earnings. Walmart apparently hopes the U.S. Congress will reward its use of tax havens by enacting legislation that would allow U.S.-based multinationals to pay little U.S. tax when repatriating current low-taxed foreign earnings (such as to fund infrastructure spending) and pay no tax with the adoption of a territorial tax system.

U.S. and foreign authorities should investigate Walmart’s tax avoidance.

Among the issues to pursue:

- The U.S. Securities and Exchange Commission should ask Walmart to explain its failure to disclose on Exhibit 21 of its SEC Form 10-K any of the 78 subsidiaries and branches Walmart has in tax havens. As a remedy for that failure, the SEC should also require the company to make public a complete list of its business entities and which of those subsidiaries Walmart has elected to designate as disregarded for U.S. tax purposes, so that investors can better evaluate the company’s tax practices.

- The Internal Revenue Service should audit Walmart’s use of subsidiaries in tax havens, including the transfer of billions of dollars to its tax-haven subsidiaries and its use of various financial instruments to move taxable income out of the United States. The IRS should also analyze Walmart’s use of short-term offshore loans to fund some of its U.S. operations without paying repatriation taxes and its deposit of offshore cash in U.S. financial institutions to determine whether Walmart has been improperly avoiding U.S. tax.

- The European Commission should determine whether Luxembourg has been providing Walmart with sweetheart tax deals equivalent to illegal state aid.

In July 2011, Mike Duke – ex Walmart CEO – testified before the Senate Finance Committee in favour of a ‘territorial’ tax system that would exempt foreign earnings of US based multinationals from US income tax.

If this system were to come into effect Walmart and many other US multinationals would be able to repatriate £2.1 trillion in profits that are currently offshore and untaxable by the US.

It seems as though Walmart has been biding its time and stockpiling its low-taxed foreign earnings offshore in anticipation of the Republican tax ‘reform’ bill, which would ‘bigly’ reduce the tax rate paid on current offshore profits that have not been taxed where they were earned and exempt them from US taxation under a territorial tax system.

In this time Walmart’s offshore ‘earnings’ have more than doubled, and international spending has declined. Walmart will argue that the money has been ‘indefinitely reinvested’, but this is an outright lie. Instead of reinvesting in the stores and employees of Asda, they have been siphoning the money to Luxembourg and forcing the staff to take the burden by cutting hours and staff.

Taxpayers spend £11bn to top up low wages paid by UK companies

Research published by Citizens UK found that companies in the UK are paying their workers so little that the taxpayer has to top up wages to the tune of £11bn a year. The four big supermarkets (Tesco, Asda, Sainsburys and Morrisons) alone are costing just under £1bn a year in tax credits and extra benefits payments.

This is a direct transfer from the rest of society to some of the largest businesses in the country. To put the figure in perspective, the total cost of benefit fraud last year was just £1bn. Corporate scrounging costs 11 times that.

Worse, this is a direct subsidy for poverty pay. If supermarkets and other low-paying employers know they can secure work even at derisory wages, since pay will be topped up by the state, they have no incentive to offer higher wages.

None of this makes sense. We are all, in effect, paying a huge sum of money so that we can continue to underpay the 22% of workers who are earning below the Living Wage – the level at which it is possible to live without government subsidies. The only possible beneficiaries are business owners.

Walmart not only indirectly steals money from economies by not paying fair share of tax

Research published by Citizens UK found that companies in the UK don’t pay staff enough and therefore forcing them to rely on government assistance. ASDA, as well as other big supermarkets (Tesco, Sainsburys and Morrisons) are costing the tax payer just under £1,000,000,000 a year in tax credits paid to top-up criminally low salaries. Meanwhile Asda workers ‘forced to sign’ new contracts or ‘face the sack’

Britain is an increasingly unequal society. Inequality here has risen more rapidly than in any other major economy over the last three decades. Piecemeal adaptations in the benefits system have attempted to cope with this. One of the larger measures was the introduction of tax credits by Labour after its election in 1997, intended to lift the low-paid out of poverty.

However, the labour market has become increasingly polarised as manufacturing employment has shrunk. Manufacturing has traditionally been better able to provide moderately well-paid, reasonably secure work. Its replacement by services employment (now over 80% of the workforce) has meant a “hollowing out” of the labour market. A few at the top do very well, but growing numbers are pushed into low-paid, insecure work. This tendency has accelerated since the crash, with record numbers on zero hours contracts, for example.

For the few not the many

Meanwhile: Asda workers ‘forced to sign’ new contracts or ‘face the sack’

Leaked Documents Expose Global Companies’ Secret Tax Deals in Luxembourg

Support Independent Journalism Today

Our unwavering dedication is to provide you with unbiased news, diverse perspectives, and insightful opinions. We're on a mission to ensure that those in positions of power are held accountable for their actions, but we can't do it alone. Labour Heartlands is primarily funded by me, Paul Knaggs, and by the generous contributions of readers like you. Your donations keep us going and help us uphold the principles of independent journalism. Join us in our quest for truth, transparency, and accountability – donate today and be a part of our mission!

Like everyone else, we're facing challenges, and we need your help to stay online and continue providing crucial journalism. Every contribution, no matter how small, goes a long way in helping us thrive. By becoming one of our donors, you become a vital part of our mission to uncover the truth and uphold the values of democracy.

While we maintain our independence from political affiliations, we stand united against corruption, injustice, and the erosion of free speech, truth, and democracy. We believe in the power of accurate information in a democracy, and we consider facts non-negotiable.

Your support, no matter the amount, can make a significant impact. Together, we can make a difference and continue our journey toward a more informed and just society.

Thank you for supporting Labour Heartlands