France’s Credit Downgrade Exposes the Eurozone Trap

For EU Rejoiners…

For years, rejoiners have claimed the economy is the reason to crawl back to Brussels. But let’s be clear: nobody can predict the markets, not the IMF, not the Bank of England, and certainly not politicians with their “50 years of doom” forecasts. Markets thrive on chaos. Boom and bust is how speculators make their billions, while governments collapse and ordinary people foot the bill.

Take the eurozone crisis. Traders coined the sneering acronym “the PIGS” to describe Portugal, Ireland, Greece, and Spain, Italy, entire nations reduced to gambling chips. Speculators crashed their bond markets, and the EU enforced austerity as constitutional law. Public services were gutted not by popular will, but to keep the markets happy.

And it hasn’t gone away. Friday saw Fitch downgrade France’s sovereign credit rating from AA- to A+ – among the lowest ratings from a major agency for the eurozone’s second-largest economy. Ballooning debt and France’s parliament’s refusal to impose more austerity on its people has created a political crisis that has seen France having its fifth prime minister since Macron was re-elected in 2022. Fitch projects France’s debt will increase to 121% of GDP by 2027 from 113.2% in 2024, with eurozone constraints leaving France wide open to the wolves of finance.

Here’s the key difference the rejoiners won’t tell you: France and every eurozone state are trapped. They borrow in euros but cannot print euros. That leaves them hostage to the bond markets, exactly as Greece was when austerity crushed it. The downgrade will raise the risk premium investors demand, increasing borrowing costs precisely when France can least afford it. Fitch downgrades France’s credit rating in new debt blow | FMT

The UK, for all the failures of both Tory and Labour governments, remains a sovereign currency nation. We borrow in pounds, and the Bank of England can always create pounds. That’s the firewall the eurozone never had, and the protection France has surrendered.

“The government’s defeat in a confidence vote illustrates the increased fragmentation and polarisation of domestic politics,” Fitch noted. “This instability weakens the political system’s capacity to deliver substantial fiscal consolidation.” In other words, when markets demand austerity but people reject it, eurozone nations face an impossible choice: democracy or market confidence. They cannot have both.

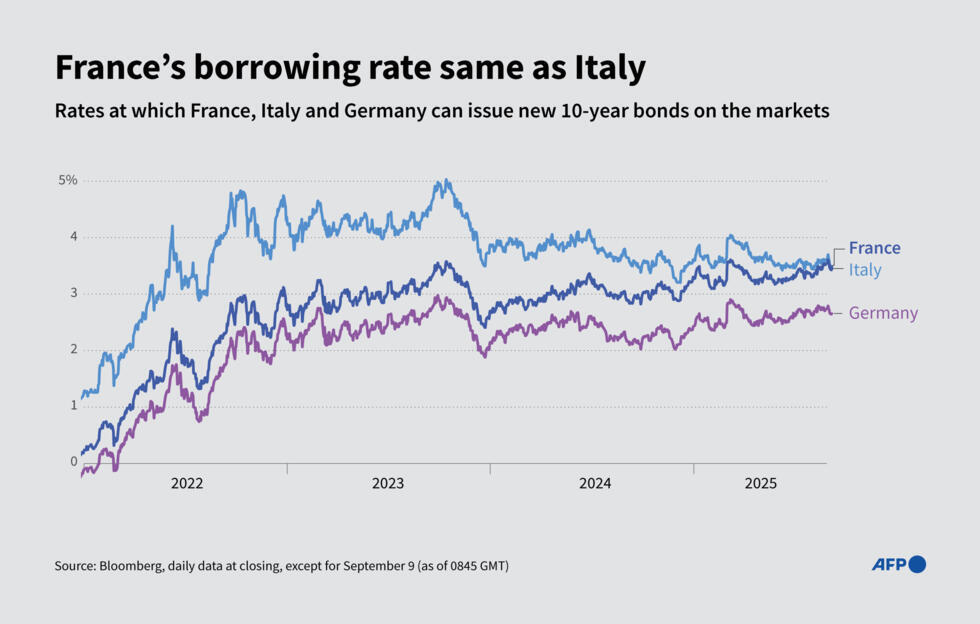

So tell me again: how was Brexit supposed to “crash the economy for 50 years,” when it’s the EU’s model that keeps crashing its own members’ economies? French 10-year government bond yields have risen to 3.47%, close to Italy’s levels, one of the eurozone’s worst performers. Fitch downgrades France’s credit rating in new debt blow | FMT This is what “European stability” looks like in practice.

The truth is simple: the EU was never built to protect working people. It was built to protect capital. The eurozone’s structure ensures that when crisis hits, ordinary citizens pay the price through enforced austerity while bond markets are protected. That’s the rigged system the rejoiners want us to return to, while the speculators move in for the kill.

Brexit may have brought its own challenges, but at least Britain retains the tools to respond to them. France, trapped in the eurozone’s golden handcuffs, can only watch as markets dictate its domestic policy.

The lesson here extends beyond monetary policy: markets don’t merely speculate, they devour entire economies, gorging themselves on public money while leaving devastation in their wake. Governments exist to protect the people they represent, not to facilitate every mechanism that allows exploitation by an oligarchy of globalists who sit quietly with their laptops, manipulating nations and households alike to feed their insatiable greed.

When democratic institutions become servants to bond markets rather than the people, we witness not economic governance but economic colonialism.

The eurozone’s architecture ensures this relationship remains permanent, while Britain, for all its current struggles, at least retains the democratic possibility of choosing a different path.

Support Independent Journalism Today

Our unwavering dedication is to provide you with unbiased news, diverse perspectives, and insightful opinions. We're on a mission to ensure that those in positions of power are held accountable for their actions, but we can't do it alone. Labour Heartlands is primarily funded by me, Paul Knaggs, and by the generous contributions of readers like you. Your donations keep us going and help us uphold the principles of independent journalism. Join us in our quest for truth, transparency, and accountability – donate today and be a part of our mission!

Like everyone else, we're facing challenges, and we need your help to stay online and continue providing crucial journalism. Every contribution, no matter how small, goes a long way in helping us thrive. By becoming one of our donors, you become a vital part of our mission to uncover the truth and uphold the values of democracy.

While we maintain our independence from political affiliations, we stand united against corruption, injustice, and the erosion of free speech, truth, and democracy. We believe in the power of accurate information in a democracy, and we consider facts non-negotiable.

Your support, no matter the amount, can make a significant impact. Together, we can make a difference and continue our journey toward a more informed and just society.

Thank you for supporting Labour Heartlands