Financial contagion refers to “the spread of market disturbances – mostly on the downside – from one country to the other, a process observed through co-movements in exchange rates, stock prices, sovereign spreads, and capital flows, or banks going bust, again!“

Another day, another banking crisis. The news that Credit Suisse is set to borrow a staggering 51 billion Swiss francs ($54 billion) from the Swiss central bank in order to shore up its balance sheet is yet another reminder of the fragility of the global financial system.

This latest crisis at Credit Suisse, one of the world’s largest and most powerful banks, highlights the ongoing dangers of a financial system that has been allowed to operate largely unchecked and unregulated. This comes after a week of US banking turmoil that has seen three major banks crash in less than a week.

Silicon Valley Bank (SVB), the nation’s 16th largest bank, failed after depositors – mostly technology workers and venture capital-backed companies – hurried to withdraw their money this week as anxiety over the bank’s situation spread.

Global institutions including the Bank of England are monitoring the situation closely amid concerns that the turmoil could put customers’ deposits at risk and lead to further panic across the financial system.

For years, banks like Credit Suisse have operated under the assumption that they are too big to fail, with the implicit understanding that they will be bailed out by governments or central banks if they get into trouble.

This comes as new fears about the health of financial institutions following the recent collapse of Silicon Valley Bank and Signature Bank in the US at one point, Credit Suisse shares lost more than a quarter of their value on Wednesday.

The share price hit a record low after the bank’s biggest shareholder, the Saudi National Bank, told news outlets that it would not put more money into the Swiss lender, which was beset by problems long before the US banks collapsed.

Bailouts are always followed by cuts in public spending.

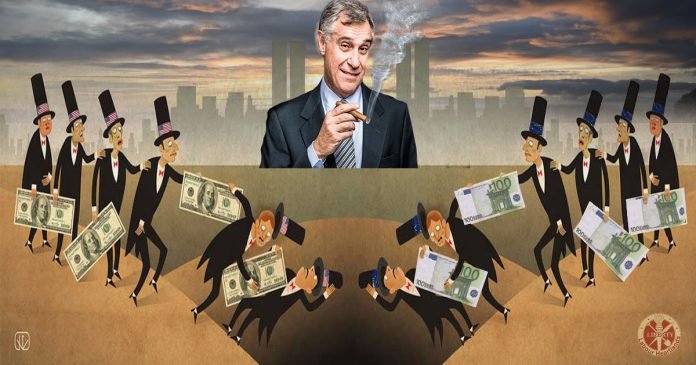

But as we saw in the aftermath of the 2008 financial crisis, these bailouts come at a high cost. The public was put on the hook for the reckless and often illegal behaviour of the banking sector, while the bankers themselves continue to reap massive profits and bonuses.

The “Too big to fail, too big to jail.” mantra cost the public nearly 15 years of austerity throughout Europe and the Western world.

More than 330,000 excess deaths in Great Britain in recent years can be attributed to spending cuts to public services and benefits introduced by the UK government after signing up for the EU Stability and Growth Pact (SGP) a set of rules designed to ensure that countries in the European Union pursue sound public finances and coordinate their fiscal policies, fiscal policies commonly known as austerity.

Studies have linked those austerity spending policies in health and social care to excess deaths in England, as well as a slowdown in life expectancy among the most deprived individuals.

The total excess deaths included 237,855 among males in England and Wales, and 12,735 among men in Scotland. There were 77,173 excess female deaths in England and Wales, and 6,564 in Scotland.

Death rates among women living in the 20% most deprived areas of England increased by 3% after a 14% decline over the previous decade. In Scotland, premature deaths in the fifth most deprived areas increased by 6% to 7% among men and women, after previous decreases of 10% to 20%.

Neoliberalism, a very dangerous idea.

The problem, at its core, is the neoliberal economic ideology that has dominated global politics for the past few decades. Under neoliberalism, the mantra is deregulation, privatisation, and globalisation, with the belief that free markets will lead to economic growth and prosperity for all. But in practice, what we’ve seen is a concentration of wealth and power among the global elite, with the vast majority of people left struggling to make ends meet.

Financial contagion.

This system is inherently unstable, as the latest Credit Suisse crisis demonstrates. Banks are allowed to take on enormous risks, gambling with other people’s money in the pursuit of ever-greater profits. When those risks pay off, the bankers reap the rewards. But when things go wrong, as they inevitably do, it’s the rest of us who pay the price.

The only way to prevent these crises from happening, again and again, is to fundamentally reform the financial system. We need to rein in the power of the banks, and hold them accountable for their actions. We need to introduce regulations that limit their ability to take on risky investments, and we need to ensure that they pay their fair share of taxes.

But ultimately, we need to move beyond the neoliberal economic paradigm altogether. We need to build a new economy that prioritizes the well-being of people and the planet, rather than the profits of the few. This will require a radical reimagining of what is possible, and a willingness to challenge the status quo. But as the latest banking crisis shows, the alternative is simply too dangerous to contemplate.

The news of Credit Suisse’s decision to borrow $51 billion from the Swiss central bank is yet another sign that the world’s financial system is on the brink of collapse. This latest banking crisis is a symptom of a larger problem that has been brewing for years – the unfettered greed and recklessness of the global financial elite.

The root of the problem lies in the system of neoliberal capitalism that has dominated the world since the 1980s. This system, which prioritizes the interests of corporations and the wealthy over the needs of ordinary people, has created an economic environment where the pursuit of profit has become the only driving force.

In this environment, banks like Credit Suisse have been able to engage in risky and speculative behaviour without any real consequences. They have been allowed to gamble with people’s money, knowing that they will be bailed out by the government if they fail.

This has led to a culture of impunity within the financial sector, where the most powerful players are able to act with complete disregard for the well-being of the rest of society. They have been able to amass incredible amounts of wealth and power, while ordinary people struggle to make ends meet.

The situation is made worse by the fact that the global financial system is interconnected, meaning that the collapse of one major bank can have a ripple effect throughout the entire system. This is what happened in 2008, when the collapse of Lehman Brothers triggered a global financial crisis. This is what is happening after the last seven days when we have seen three US banks collapse in less than a week.

These developments in the US banking sector have sent shockwaves throughout the financial world, with the collapse of Silicon Valley Bank (SVB) marking yet another failure in the industry. The events of the past few days have highlighted the ongoing financial instability not only in the US but now spreading into Europe as regulators struggle to contain the fallout from the bank’s collapse and prevent a wider banking crisis.

SVB’s collapse was triggered by the bank’s need to raise capital after selling securities at a loss, leading to a bank run as customers withdrew their deposits. The bank’s failure has rightly sparked fears of a wider contagion effect, with other banks coming under scrutiny and regulators forced to take action, this is no longer stress testing this is a collapse.

The fact that Credit Suisse is now having to borrow billions of dollars from the Swiss central bank is a clear sign that the system is once again on the brink of collapse. It is a stark reminder that the neoliberal model of capitalism is not sustainable, and that it is time for a fundamental rethink of our economic system.

We need to build an economy that prioritises the needs of people and the planet over the interests of corporations and the wealthy. This means moving away from the pursuit of profit at all costs and towards a model that values social and environmental outcomes as well.

It also means holding the financial elite accountable for their actions. We need to put an end to the culture of impunity that has allowed banks like Credit Suisse to act with complete disregard for the well-being of the rest of society.

In conclusion, the latest banking crisis involving Credit Suisse is a clear sign that the global financial system is in crisis. It is time for a fundamental rethink of our economic system, one that prioritizes the needs of people and the planet over the interests of corporations and the wealthy. We need to build an economy that is sustainable, equitable, and just, and that holds the financial elite accountable for their actions.

Support Independent Journalism Today

Our unwavering dedication is to provide you with unbiased news, diverse perspectives, and insightful opinions. We're on a mission to ensure that those in positions of power are held accountable for their actions, but we can't do it alone. Labour Heartlands is primarily funded by me, Paul Knaggs, and by the generous contributions of readers like you. Your donations keep us going and help us uphold the principles of independent journalism. Join us in our quest for truth, transparency, and accountability – donate today and be a part of our mission!

Like everyone else, we're facing challenges, and we need your help to stay online and continue providing crucial journalism. Every contribution, no matter how small, goes a long way in helping us thrive. By becoming one of our donors, you become a vital part of our mission to uncover the truth and uphold the values of democracy.

While we maintain our independence from political affiliations, we stand united against corruption, injustice, and the erosion of free speech, truth, and democracy. We believe in the power of accurate information in a democracy, and we consider facts non-negotiable.

Your support, no matter the amount, can make a significant impact. Together, we can make a difference and continue our journey toward a more informed and just society.

Thank you for supporting Labour Heartlands